Elon Musk, the man who brought us Tesla (NASDAQ:TSLA), SpaceX, The Boring Company, and even PayPal (NASDAQ:PYPL), now brings us one more company: xAI. With a focus on artificial intelligence, this company has some big ambitions, even if it doesn’t yet have an IPO to invest in.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Musk described xAI’s purpose as helping people understand “…the nature of the universe.” In doing so, Musk has pulled a lot of top-end technical talent together, including former employees of Microsoft (NASDAQ:MSFT), Google (NASDAQ:GOOG), and even Tesla and OpenAI. The new company notes that it isn’t part of X Corp, the larger umbrella corporation that owns Twitter but does “work closely” with Twitter, suggesting some connection of an unknown depth and value.

Musk’s opposition to artificial intelligence is widely known. Back in April, Musk detailed in one interview how AI could cause “civilization destruction,” though the odds of it actually doing so were merely “non-trivial.” Musk also, in a somewhat uncharacteristic move, called for AI to be regulated by the government, noting that, should such regulation not occur, it could eventually be too late for it to ever actually occur in any case. Whether that’s because regulation would be moot, impossible to enact, or because the AIs in question would prevent it is, however, unclear.

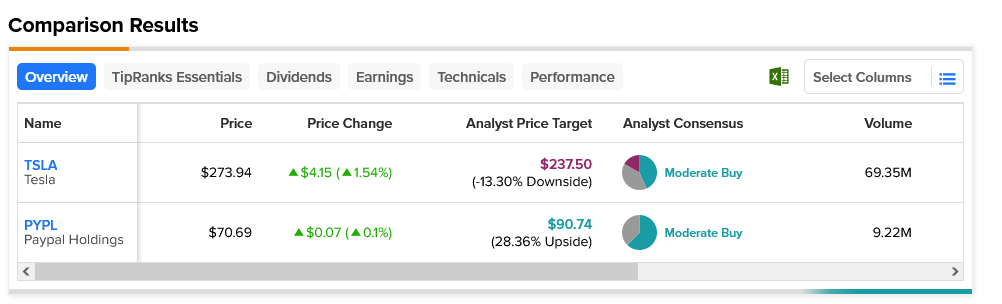

The companies connected with Musk, meanwhile, are still doing reasonably well. Both PayPal and Tesla are considered Moderate Buys by analysts. However, PayPal boasts 28.36% upside potential thanks to its $90.74 average price target. Meanwhile, Tesla’s average price target of $237.50 comes with 13.3% downside risk.