Tesla shareholders approved Elon Musk’s record $1 trillion pay package, built around massive performance targets. Experts say the billionaire’s use of “anchoring” is a tactic everyday investors can learn from when negotiating or setting financial goals.

Elon Musk Just Secured a $1 Trillion Tesla Package. Here’s What You Can Learn From It.

Story Highlights

Tesla investors (TSLA) signed off on Elon Musk’s 2025 pay plan, a bundle of roughly 425 million incentive-tied shares that vest only if he hits ten-year targets. The goals include $400 billion in EDITDA over a 12-month span, while Wall Street pegs 2025 EBITDA near $13 billion, so the bar is very high. The vote was not close, passing by more than three to one. One attendee even quipped, “Congrats on not having to show up to work for free anymore.”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The package aims to bring Musk’s ownership back toward 25 percent over time. This sits on top of past awards, including the voided 2018 plan that shareholders re-approved and that is currently worth about $120 billion, and an earlier 2012 grant worth roughly $34 billion today.

Musk Anchors Expectations

Why 25 percent, and why $1 trillion of potential value, are fair questions. Negotiation researchers would say this is a classic anchoring move. “We get skewed very quickly, and part of that is about the psychological phenomenon of anchoring,” said Jo-Ellen Pozner, associate professor at Santa Clara University’s Leavey School of Business. “Anchoring is the principle that explains why it’s a good idea to make the first offer in a negotiation,” she added. Set a number at the start, and the final outcome drifts closer to it.

This helps explain how a number that large became the reference point. As Pozner put it when asked how a board arrives at $1 trillion, “Ego.”

Everyday Investors Can Borrow the Playbook

You do not need a rocket company to use anchoring. Go into a performance review with a specific, well-researched ask, then back it up with measurable outcomes. Lead with the number, bring evidence, and give your manager an easy way to say yes, for example a path that ties more pay to clear milestones. If you negotiate for a new role, start higher than your minimum acceptable pay, then trade toward benefits, equity, or flexibility while protecting the headline number.

If you are allocating capital, anchor your own process. Write down the valuation range you believe is fair before you look at the market price, then force any change in that range to be justified by new facts, not headlines.

Context Puts the Trillion in Perspective

Even spread across a decade, the math is staggering. Hit every milestone, and it works out to hundreds of millions per day on a work-week basis. The average S&P 500 (SPX) CEO makes about $20 million per year. Musk’s path, if achieved, would eclipse that daily.

Investors do not have to love the size to learn from the structure. Big goals, clear milestones, performance-based rewards, and early anchoring are levers anyone can use, whether you are negotiating a raise, pitching a client, or mapping your own long-term plan.

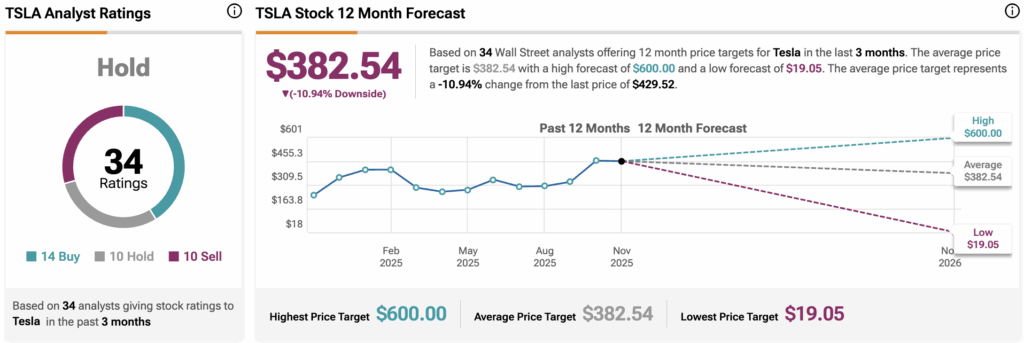

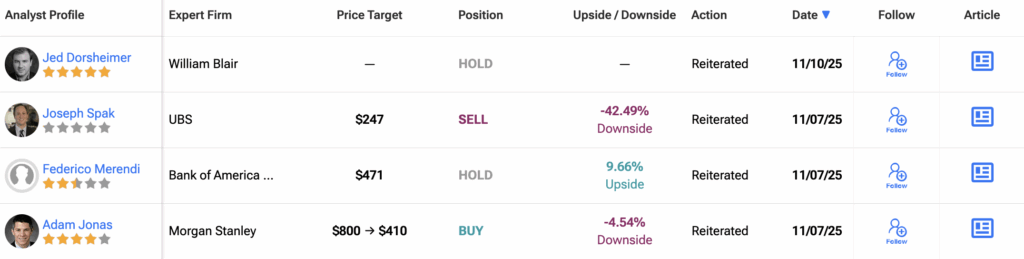

Is Tesla Stock a Buy, Hold, or Sell?

According to TipRanks, TSLA stock has received a Hold consensus rating based on 14 Buys, 10 Holds, and 10 Sells assigned in the last three months. The average 12-month TSLA stock price target is $382.54, suggesting a potential downside of 11% from the current level.

1