Tesla (TSLA) investors signed off on a new stock option award for Elon Musk that could be worth roughly $1 trillion over the next decade if all targets are met. The vote capped an upbeat annual meeting in Austin where Musk thanked a crowd that felt more like a fan convention than a standard shareholder gathering.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Fans Compare Tesla to Berkshire

The meeting drew direct Berkshire Hathaway comparisons from the stage and the floor. One shareholder, Alexandra Merz, told the room, “This is a nice venue, we love coming to the factory…but there are thousands of retail investors who are crying because they cannot [attend]…Please organize a bigger venue.” She added, “We’re bigger than Berkshire and we will do better than Berkshire.”

Musk agreed that a larger venue makes sense. If he follows through, the annual meeting could turn into a broader showcase for his companies, from SpaceX and xAI to Neuralink and The Boring Company.

Pay Structures Diverge, but Incentives Align

Fans also drew parallels between Musk and Warren Buffett on pay philosophy. Buffett takes about $400,000 a year, and his wealth comes from Berkshire (BRK.B) stock. Musk does not draw a traditional Tesla salary, and his wealth is tied to Tesla and other holdings. The average S&P 500 CEO earns about $20 million a year. By comparison, Musk’s 2018 award was valued at about $56 billion, and those options are now worth closer to $130 billion. Berkshire does not issue giant stock awards to Buffett.

Market Reaction Stays Measured

After the meeting, TSLA traded only slightly higher in early Friday action while S&P 500 (SPX) and Dow futures ticked lower. The muted move is not a shock. The package was widely expected to pass, and Tesla’s board and investor base have long favored incentive-heavy structures for Musk.

Street Focus Moves to AI

With the vote behind it, Wall Street attention tilts to execution. Wedbush’s Dan Ives wrote that the “focus shifts to AI,” calling the outcome a confidence boost. The vote cemented “Musk as a wartime CEO as the AI Revolution takes hold, giving us greater confidence in the Tesla story moving forward.”

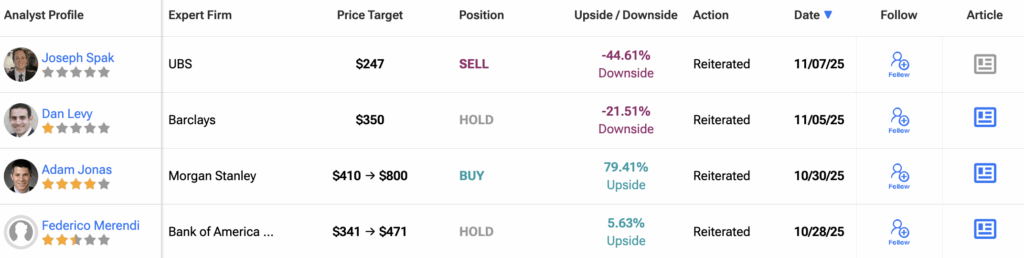

Ives remains one of the most bullish voices on the stock, keeping a Buy rating and a $600 price target, well above the ~$400 average.

What Should Investors Look Out for Next?

Investors should look for concrete updates on full self driving, robotics, energy storage, and Tesla’s custom compute plans. The company’s meetings may keep growing, but the stock will still track delivery trends, margins, software take rates, and progress on autonomy.

If the AI roadmap converts to revenue at scale, the Berkshire comparisons will feel less rhetorical and more financial. If it stalls, the conversation will shift back to cars, costs, and cash.

Is Tesla Stock a Buy, Hold, or Sell?

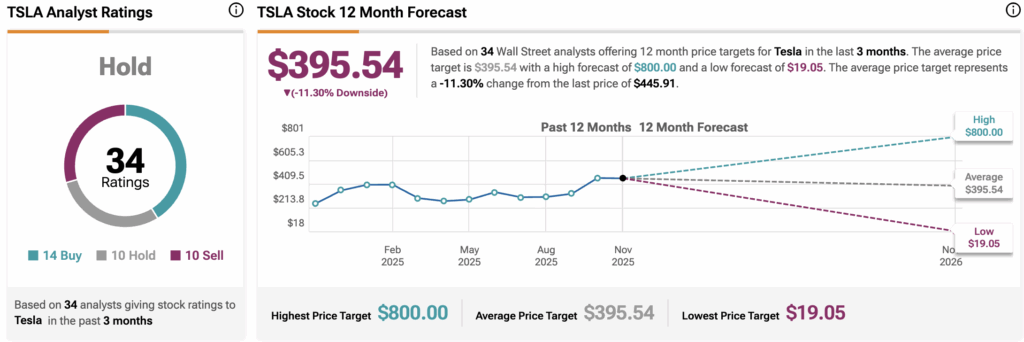

According to TipRanks, TSLA stock has received a Hold consensus rating based on 14 Buys, 10 Holds, and 10 Sells assigned in the last three months. The average 12-month TSLA stock price target is $395.54, suggesting a potential downside of 11.30% from the current level.