Eli Lilly’s (NYSE:LLY) weight loss medication, Zepbound (tirzepatide), is now available for adults in the U.S. This injection is targeted for obese adults with a BMI (body mass index) of 30 or higher or for overweight adults with a BMI of 27 or higher (along with weight-associated medical problems). Zepbound was approved by the U.S. Food and Drug Administration (FDA) last month.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Notably, the injection can be accessed via prescriptions that can be filled at retail or mail-order pharmacies. Additionally, Express Scripts and Cigna Healthcare are adding Zepbound to their National Preferred Formulary.

Rhonda Pacheco, Group Vice President at Lilly Diabetes and Obesity, U.S., commented, “Today opens another chapter for adults living with obesity who have been looking for a new treatment option like Zepbound. We are excited to see growing coverage in the marketplace, giving millions of Americans access to Zepbound.”

A recent study in over 40,000 adults revealed that tirzepatide was three times more likely to prompt a 15% weight loss than Novo Nordisk’s (NYSE:NVO) semaglutide. Importantly, Lilly noted that it is continuing to invest in expanding its global manufacturing footprint to meet the anticipated demand for treatments such as Zepbound. Both Lilly and NVO are racing to grab a share of the obesity market. While Lilly plans to invest nearly $2.17 billion in a new plant in Germany, NVO is looking to expand its facilities in Denmark with a $6 billion investment.

What is the Target Price for LLY?

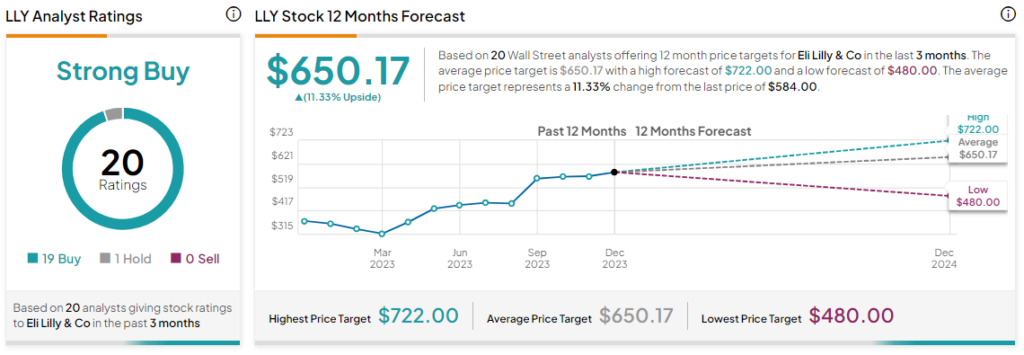

Overall, the Street has a Strong Buy consensus rating on Eli Lilly. Following a nearly 59% jump in its share price over the past year, the average LLY price target of $650.17 implies a modest 11.3% potential upside in the stock.

Read full Disclosure