Shares of healthcare major Eli Lilly & Co. (NYSE:LLY) are up nearly 17% at the time of writing today after the company posted better-than-anticipated second-quarter numbers. Revenue rose 28% year-over-year to $8.31 billion, outperforming estimates by $700 million. EPS at $2.11, too, surpassed expectations by $0.13.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The uptick in sales came on the back of higher volumes in Mounjaro, and growth products Verzenio, Jardiance, and Taltz. Further, the combination of higher prices and volumes helped the company deliver a 41% growth in its U.S. revenue and a 9% growth in revenue outside the U.S. Trulicity sales, though, declined 5% over the prior year period to $1.81 billion.

Buoyed by this performance, Eli Lilly has now boosted its financial expectations for Fiscal Year 2023. Revenue is expected to hover between $33.4 billion and $33.9 billion compared to the prior outlook between $31.2 billion and $31.7 billion. EPS for the year is expected between $9.70 and $9.90 versus to the previous outlook between $8.65 and $8.85.

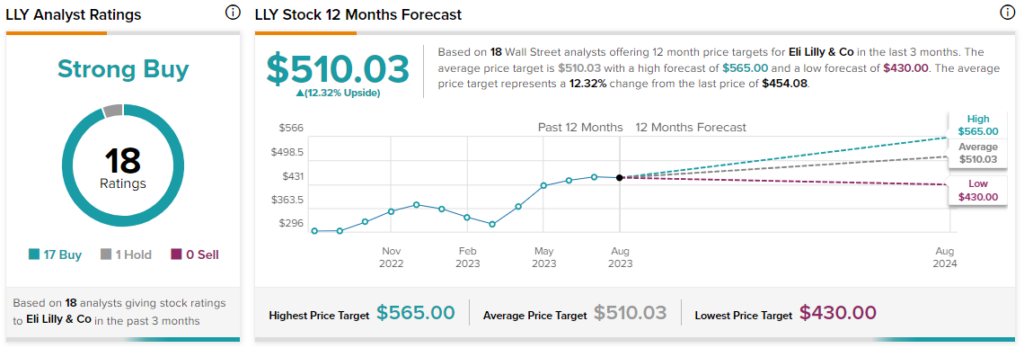

Overall, the Street has a $510.03 consensus price target on LLY alongside a Strong Buy consensus rating. Today’s price gains come on top of a 50.1% surge in LLY shares over the past year.

Read full Disclosure