Eli Lilly (NYSE:LLY) announced on Friday that it had more than doubled its investment in its manufacturing site in Lebanon, Indiana to $5.3 billion. With this investment, the pharmaceutical company increased its investment in the site from $3.7 billion to $9 billion – its largest manufacturing investment in the company’s nearly 150-year history.

The company increased its investment to enhance the production capacity of its popular weight loss drug, Zepbound, the diabetes treatment Mounjaro, and other pharmaceuticals. Eli Lilly anticipates that the Lebanon site will commence medicine production by late 2026 and gradually scale operations through 2028.

Why is LLY Increasing Its Manufacturing Capacity?

LLY first announced the expansion of its manufacturing sites in Indiana in 2022. The plant is expected to increase the company’s capacity for manufacturing tirzepatide, the active ingredient in Zepbound and Mounjaro. The company refers to these drugs as “incretin drugs” that suppress appetite and regulate blood sugar.

The demand for these drugs has far outpaced supply over the past year, leading to shortages in the U.S. and prompting LLY to invest heavily in scaling up its manufacturing capacity.

The production site in Lebanon, Indiana is expected to have 900 employees when it is fully operational.

Is LLY Stock a Buy?

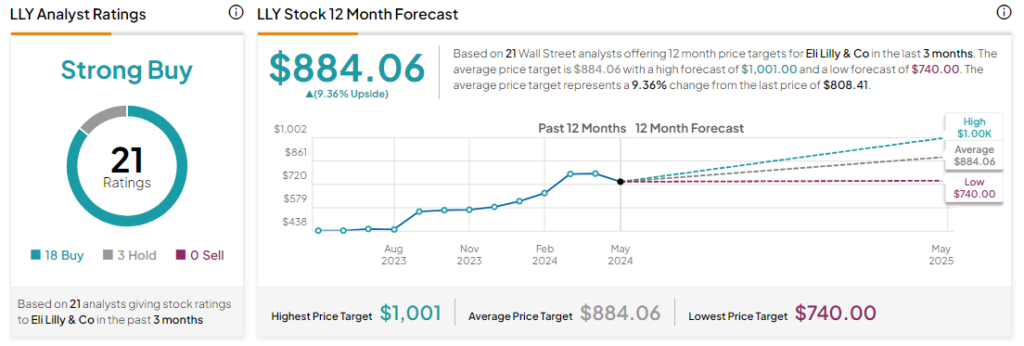

Analysts remain bullish about LLY stock, with a Strong Buy consensus rating based on 18 Buys and three Holds. Year-to-date, LLY has increased by more than 35%, and the average LLY price target of $884.06 implies an upside potential of 9.4% from current levels.