Eli Lilly and Co. (LLY) has opened a new biotechnology innovation hub in San Diego, California, as U.S. President Donald Trump again threatens to impose 100% tariffs on the pharmaceutical industry.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The new Lilly Gateway Labs (LGL) site in San Diego expands the company’s network of innovation hubs that are designed to support early-stage biotechnology research and discoveries. The 82,514-square-foot facility can accommodate up to 15 life sciences companies and more than 250 employees.

The San Diego location joins Gateway Lab sites that already exist in San Francisco and Boston. Eli Lilly’s Gateway Labs provide startup biotech companies with access to laboratory facilities, scientific research, and strategic guidance to help them navigate the drug discovery process and pipeline.

U.S. Investments

The new facility in San Diego is opening as President Trump again threatens to impose a 100% tariff on all pharmaceutical drugs imported into the U.S. unless companies invest in manufacturing medicines within America and work to bring prescription drug prices lower.

Eli Lilly has announced several major new investments in the U.S. in recent months. Earlier in September, the company announced plans to spend $6.5 billion building a new state-of-the-art manufacturing plant in Houston, Texas, that will produce its upcoming weight-loss pill.

The company announced earlier this year that it plans to spend a total of $27 billion to build four new U.S. manufacturing plants, adding to $23 billion of investments made since 2020.

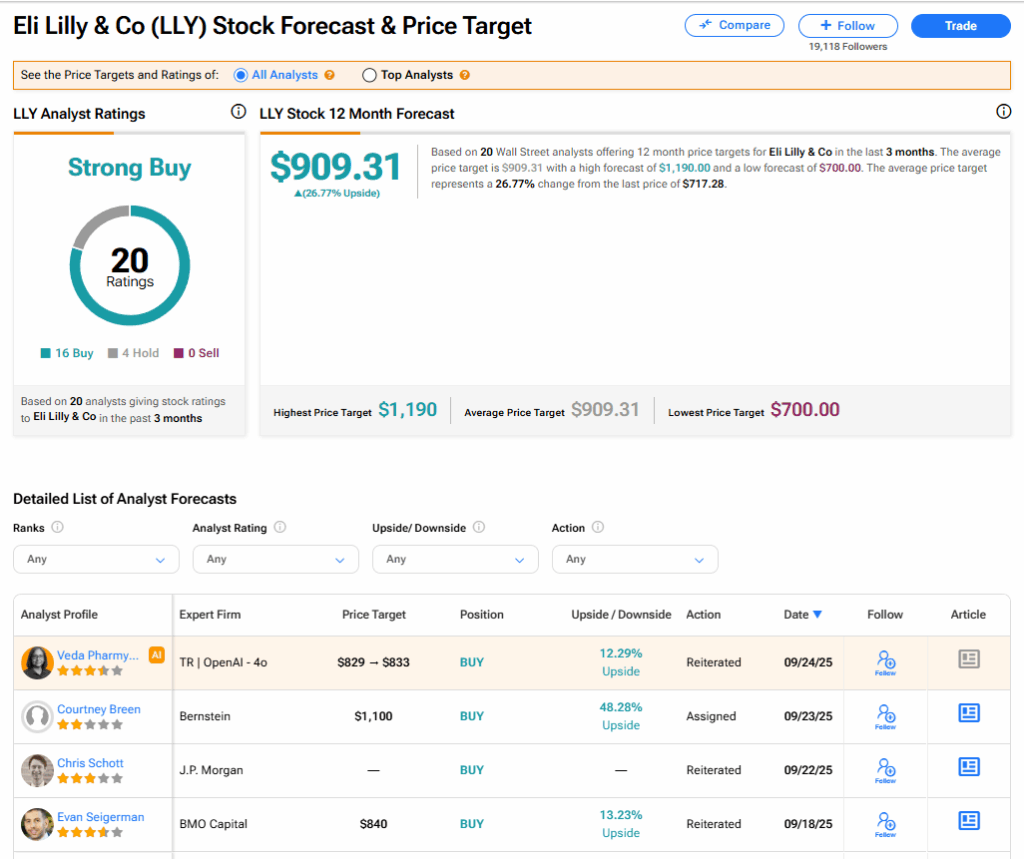

Is LLY Stock a Buy?

The stock of Eli Lilly has a consensus Strong Buy rating among 20 Wall Street analysts. That rating is based on 16 Buy and four Hold recommendations issued in the last three months. The average LLY price target of $909.31 implies 26.77% upside from current levels.