U.S. pharmaceutical giant Eli Lilly (LLY) has announced plans to spend $6.5 billion building a new state-of-the-art manufacturing plant in Houston, Texas, that will produce its upcoming weight-loss pill.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Texas facility will manufacture other medications besides the obesity pill that the company plans to launch worldwide in 2026, pending regulatory approval. However, analysts and investors are mostly fixated on the weight-loss pill that is expected to be a global bestseller for Eli Lilly.

The Texas plant is the latest in a series of U.S. investments from Eli Lilly. The company announced earlier this year that it plans to spend $27 billion to build four new U.S. manufacturing plants, adding to $23 billion of investments made since 2020.

More to Come

Eli Lilly said it will announce two remaining U.S. manufacturing sites by year’s end. Analysts say that production capacity for Eli Lilly’s new weight-loss pill, called Orforglipron, is critically important as the company races to bring it to market and maintain its dominant market position.

Eli Lilly and other drug makers have been scrambling to boost their production in the U.S. as President Donald Trump threatens to impose tariffs on pharmaceuticals imported into America. President Trump is encouraging companies to re-shore production and manufacturing to the U.S.

“As shared last week, and as we await word from FDA by Q4 2025, production for our potential Wegovy in a pill 25mg has already begun at our North Carolina facilities. These Novo Nordisk manufacturing sites will support API production, fill-finish and tableting operations, allowing Novo Nordisk to run in a US-to-US supply chain,” said Dave Moore, executive vice-president of U.S. operations at Novo Nordisk (NVO).

Eli Lilly’s new manufacturing plant is expected to create 615 jobs in the Houston area, including highly skilled engineers, scientists, operations personnel, and lab technicians. It will also create 4,000 construction jobs.

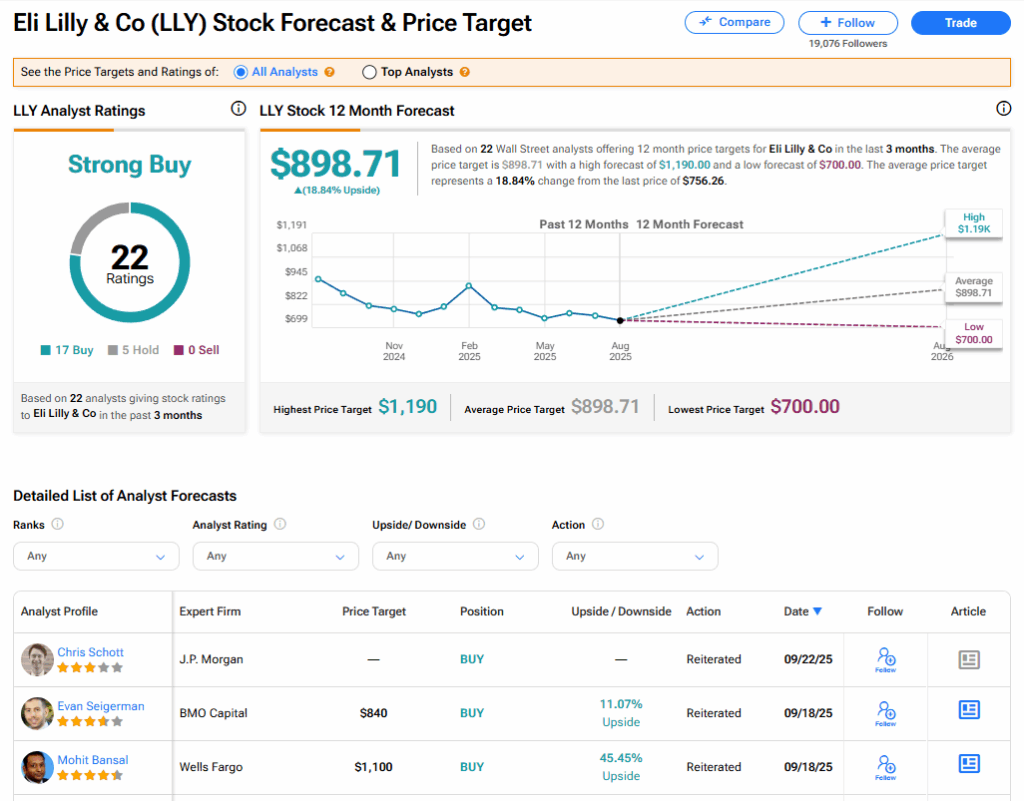

Is LLY Stock a Buy?

The stock of Eli Lilly has a consensus Strong Buy rating among 22 Wall Street analysts. That rating is based on 17 Buy and five Hold recommendations issued in the last three months. The average LLY price target of $898.71 implies 18.84% upside from current levels.