Shares of video game company Electronic Arts, Inc. (EA) rose 3.4% in the extended trading session and closed at $144.61 after it reported better-than-expected results for the fiscal first quarter. The strong results were primarily driven by the growth in net revenues.

Electronic Arts reported quarterly net revenues of $1.55 billion, up 6.3% from the same quarter last year. The growth in net revenues was supported by an 11.7% year-over-year increase in Live services and other revenues. Moreover, the revenues surpassed the consensus estimate of $1.28 billion.

Earnings per share (EPS) for the quarter declined 43.2% from the previous year to $0.71. It, however, topped the consensus estimate of $0.62.

Meanwhile, for the second quarter and Fiscal Year 2022, the company anticipates net revenues of $1.78 billion and $6.85 billion, respectively. It expects EPS of $0.36 in the second quarter and $1.58 for the fiscal.

The CEO of Electronic Arts, Andrew Wilson, said, “Our new launches, leading games, and live services all had an outstanding quarter. With our expanding EA SPORTS portfolio, more amazing experiences in Apex Legends, the groundbreaking new Battlefield 2042, and our leading live services including mobile, we’re set to deliver more great games and content to players this year.” (See Electronic Arts stock chart on TipRanks)

On August 2, Credit Suisse analyst Stephen Ju reiterated a Buy rating on the stock. The analyst, however, raised the price target from $165 to $174 (24.4% upside potential).

“Mobile remains the key focus area for EA, as it announced its second major acquisition this year for $1.4B in cash. This should add to management’s prior moves to unlock the mobile opportunity by exporting major console/PC franchises into a larger mobile audience and bringing a wider array of genres/game mechanics to its existing mobile games to increase broader appeal,” the analyst noted.

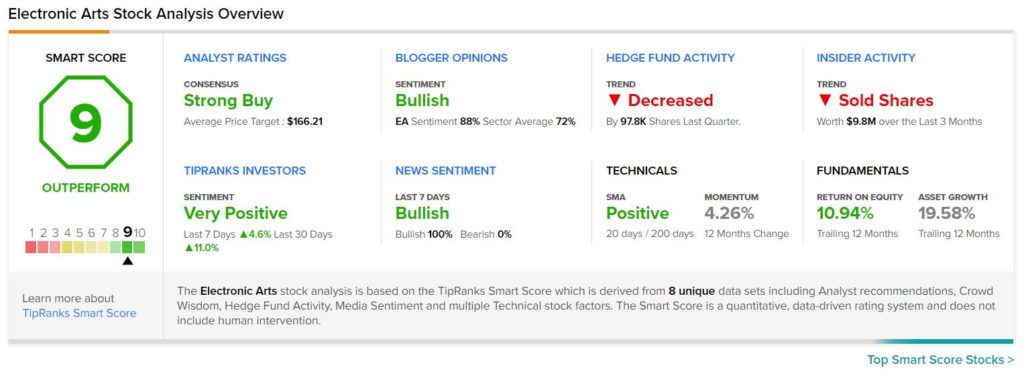

Consensus among analysts is a Strong Buy based on 17 Buys and 4 Holds. The average Electronic Arts price target of $166.21 implies upside potential of 18.8% from current levels.

Electronic Arts scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations. Shares have declined 4.3% over the past year.

Related News:

KKR’s Q2 Earnings Surge 153%; Shares Gain Nearly 2%

Lyft Reports Mixed Q2 Results

Cummins Reports Better-than-Expected Q2 Results; Shares Rise