Electronic Arts (NASDAQ:EA) is laying off about 6% of its workforce and reducing office space as part of its restructuring plan. The company aims to prioritize investments by focusing on growth opportunities and optimizing its real estate portfolio.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

EA develops and manufactures electronic games for Internet-connected consoles, mobile devices, and personal computers.

The company expects the restructuring plan to be executed by the end of September 2023. Further, EA anticipates the move to result in restructuring charges between $170 and $200 million.

The move marks EA’s first major attempt to control costs by trimming headcount. The company had begun informing employees about layoffs earlier this quarter and will likely keep doing so until April.

Tech companies’ performance is still impacted by high inflation, economic uncertainty, and the high-cost burden associated with overstaffing during the pandemic. Earlier this month, tech giants Amazon (AMZN) and Meta Platforms (META) announced the second round of massive headcount reductions.

Is EA Stock Expected to Rise?

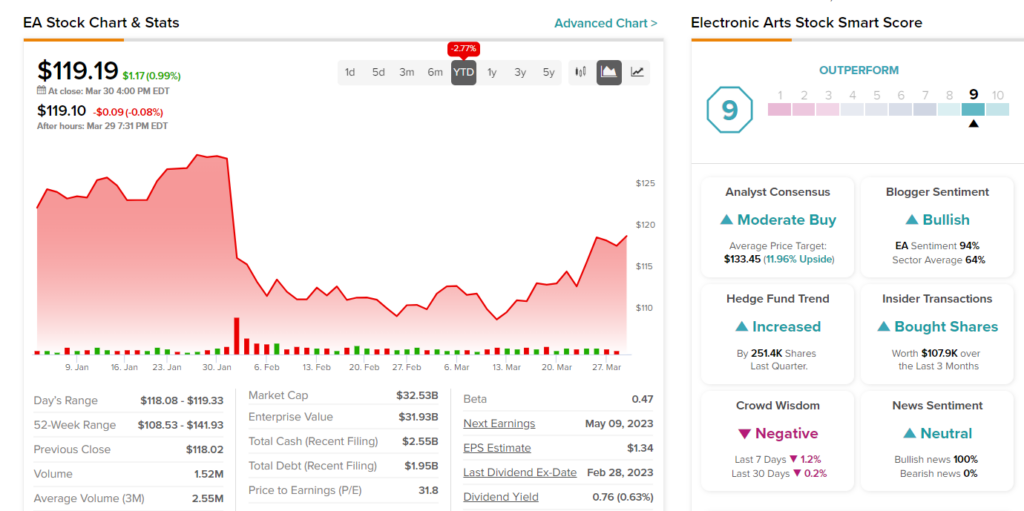

Turning to Wall Street, EA stock has a Moderate Buy consensus rating. That’s based on 14 Buys and eight Holds assigned in the past three months. The average price target of $133.45 implies 12% upside potential. The stock has declined 2.8% so far in 2023.

It is worth mentioning that both insiders and hedge funds are bullish on EA stock. Moreover, the stock carries an Outperform Smart Score of nine on TipRanks, which implies it has the potential to beat market averages.