It was not a good day for the electric vehicle stock market today. In fact, multiple electric vehicle stocks were down in Tuesday afternoon’s trading. Several factors came together to send the EV market on a general decline. The biggest of these was the overall macroeconomic environment, which is increasingly leaning toward a “hard landing” recession for the U.S. economy. Despite weeks, even months, of insistence to the contrary, the “hard landing” scenario now seems the most likely.

Moreover, EV makers—impacted by declining demand for their products—are engaging in more price cutting. Ford, for example, cut the cost of its Mustang Mach-E by as much as $8,100, along with some financing incentives.

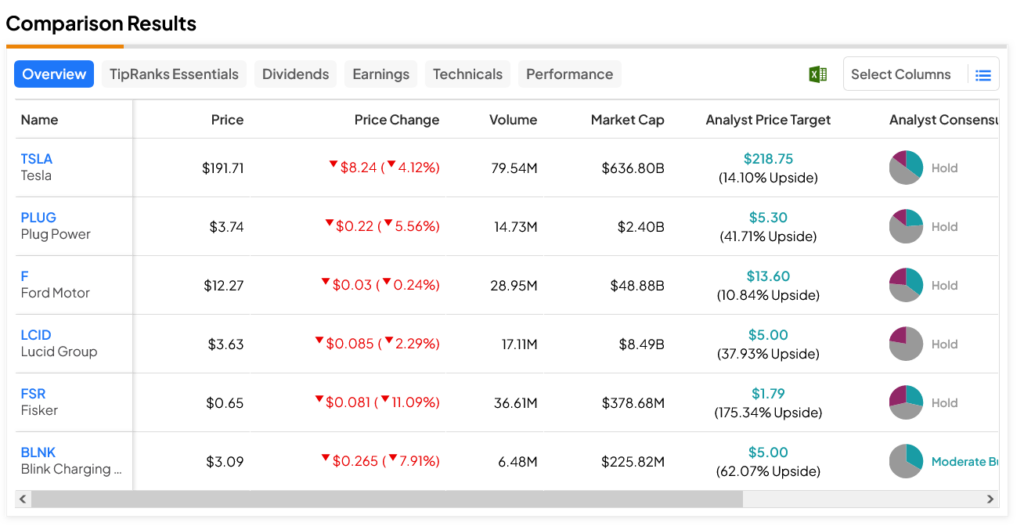

EV stocks were impacted differently in today’s trading. Ford (NYSE:F) got off the lightest, down only fractionally. However, Lucid Group (NASDAQ:LCID) dropped over 2%, Tesla (NASDAQ:TSLA) sputtered to an over 4% loss, Plug Power (NASDAQ:PLUG) slid over 5.5%, and Blink Charging (NASDAQ:BLNK) lost 8%. Worst of all, Fisker (NYSE:FSR) plummeted just over 11% in Tuesday afternoon’s trading.

Prices and Demad Are Declining

The problem, in a nutshell, for electric vehicle makers is that the price cutting is a response to declining demand. That means there are fewer of their cars being sold right now, and at lower prices per car. Further, this weighs heavily on infrastructure makers; while theirs is more of a knock-on impact—the cars already sold still require chargers and the like—it’s still a limiting effect. That’s why you see stocks like Plug Power and Blink Charging declining today.

Which Electric Vehicle Stocks Are a Good Buy Right Now?

Turning to Wall Street, FSR stock is the leader in the sector. With an average price target of $1.79, this Hold-rated stock offers investors a hefty 175.34% upside potential. Meanwhile, Ford stock is the laggard, as this Hold-rated stock offers just 10.84% upside potential against its average price target of $13.60 per share.