Two Chinese eCommerce rivals are about to face off in a U.S. District court. PDD Holdings’ (NASDAQ:PDD) Temu, known for its affordable product offerings, has accused rival Shein of resorting to intimidation tactics against suppliers that work with both companies, according to Reuters.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Reportedly, Temu has alleged that Shein misused IP legislation to wean suppliers and merchants away from Temu and detained vendor representatives in its offices, threatening them with penalties. While Temu is based in the U.S., Shein is based in Singapore. Both companies have seen staggering growth in the U.S. market as consumers look to shop on ever-tightening budgets.

Temu is also accusing Shein of poaching talent. Still, this is not the first time the two companies are trading barbs. Earlier, Shein accused Temu of using social media influencers to ratchet up negative remarks about the platform, and Temu has alleged Shein’s violation of U.S. antitrust laws.

For Shein, the lawsuit comes just weeks after the company filed to go public in the U.S. According to Reuters, Shein has grabbed about 18% of the global fast fashion market pie.

Meanwhile, Temu has firmly entrenched itself in the U.S. market in less than two years after entry. The company commands a 17% market share in the discount stores category in the U.S., eating into market shares of brick-and-mortar discount retailers such as Five Below (NASDAQ:FIVE) and Dollar General (NYSE:DG).

Is PDD a Good Stock to Buy?

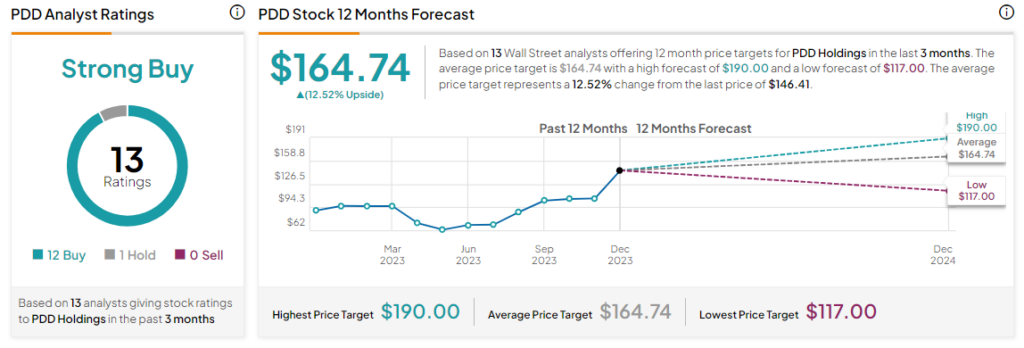

Overall, the Street has a Strong Buy consensus rating on PDD Holdings. Following a nearly 89% rally in the company’s share price over the last six months, the average PDD price target of $164.74 points to a modest 12.5% potential upside in the stock.

Read full Disclosure