Driven by the sales of its affordable offerings, shares of PDD Holdings (NASDAQ:PDD) have had an impressive run this year, with a nearly 63% price surge. According to a Reuters report, the Chinese company’s eCommerce platform, Temu, is outperforming discount retailers such as Five Below (NASDAQ:FIVE) and Dollar General (NYSE:DG) in the U.S.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to Earnest Analytics, Temu commands a 17% market share in the discount stores category in the U.S. In comparison, Five Below has an 8% market share. In addition, although Dollar General holds a 43% market share, its same-store sales are under pressure.

This is an impressive feat for Temu, considering it only entered the U.S. market about 15 months ago. The platform has banked on social media influencers to attract users. Additionally, its extremely lower-priced products and novelty factor could be a challenge for retailers with a brick-and-mortar presence since it ships products directly to users from manufacturers in China.

Last week, PDD’s third-quarter top line soared 94% year-over-year to $9.44 billion. The company witnessed a 39% increase in Online Marketing Services revenue and a 315% jump in Transaction Services revenue. Moreover, it is sitting on $27.8 billion of dry powder. In comparison, Dollar General’s Q3 revenue increased by 2.4% year-over-year to $9.69 billion, and it expects same-store sales growth of 0% to -1% for FY23.

Is PDD a Good Investment?

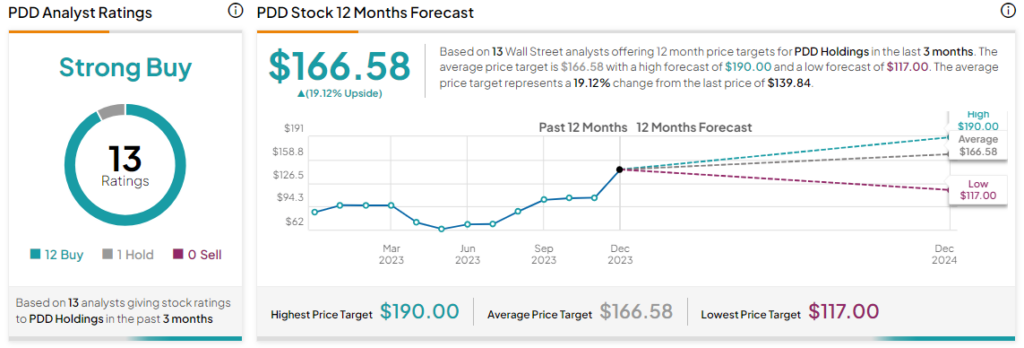

Overall, the Street has a Strong Buy consensus rating on PDD Holdings, and the average PDD price target of $166.58 implies that the rally in the stock may still have some steam left.

Read full Disclosure