Global commerce company eBay (NASDAQ:EBAY) delivered better-than-expected fourth-quarter financials despite macro headwinds. Further, the company raised its quarterly dividend by 8% to $0.27 per share, reflecting a forward yield of 2.4%. EBAY stock gained over 3% in Tuesday’s after-hours trading.

In addition to the dividend boost, eBay approved a new $2 billion stock repurchase program, increasing the total authorization for stock buybacks to $3.4 billion. Against this backdrop, let’s look at the company’s Q4 performance.

eBay Exceeds Estimates in Q4

eBay delivered revenue of $2.6 billion in Q4, up 2% year-over-year. This came higher than the Street’s estimate of $2.51 billion. The continued momentum in first-party advertising and higher gross merchandise volume (GMV) supported the company’s top line during the fourth quarter.

eBay’s total advertising revenue grew 20% to $393 million. The first-party ads grew 30% to $368 million. eBay delivered adjusted earnings of $1.07 per share in Q4, which remained flat year-over-year. However, it exceeded analysts’ EPS expectations of $1.03.

Q1 Outlook

eBay expects to deliver GMV between $18.2 and $18.5 billion in Q1. Additionally, the company projects its top line to be in the range of $2.5 billion to 2.54 billion, compared to the analysts’ forecast of $2.53 billion. The ongoing strength in the first-party advertising business, international shipping, and improvement in its financial services offerings are expected to support its revenue growth.

The company expects to generate adjusted EPS between $1.19 and $1.23 in the first quarter, reflecting a year-over-year growth of 7% to 11%.

Is eBay Stock a Buy or Sell?

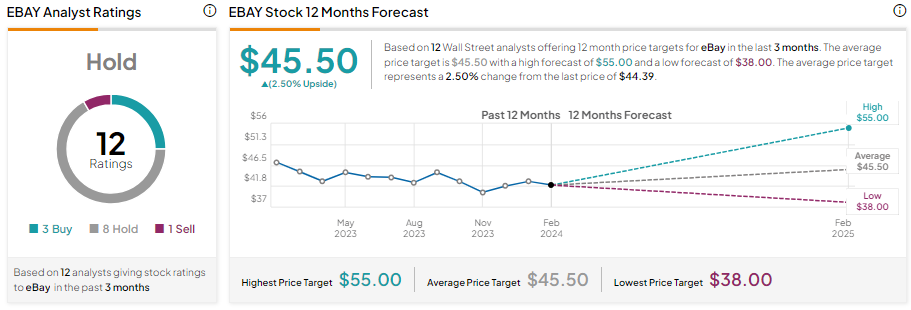

eBay stock is down about 1% over the past year, underperforming the S&P 500’s (SPX) nearly 28% gain. Despite this underperformance, analysts’ average price target shows limited upside potential in EBAY stock over the next 12 months.

Moreover, analysts remain sidelined on EBAY stock as the company navigates macro headwinds. It has three Buys, eight Holds, and one Sell recommendation for a Hold consensus rating. Analysts’ average price target of $45.50 implies 2.5% upside potential from current levels.

It’s worth noting that most of the price targets on EBAY stock were set before its Q4 earnings report. This raises the possibility that eBay stock might witness upward adjustments in price targets following its solid Q4 performance.