Some days it just doesn’t pay to get out of bed. Online learning center Coursera (NYSE:COUR) learned just that with a series of unfortunate events in Friday’s trading. A disappointing earnings report kicked things off, then insult piled onto injury as Cantor Fitzgerald weighed in.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Cantor Fitzgerald, via analyst Brett Knoblauch, dropped his rating on Coursera from Buy to Hold after an earnings report that brought not only disappointing numbers but also underwhelming guidance. With Coursera’s growth also likely to slow this year, investor confidence is waning. However, Josh Baer at Morgan Stanley offered something of a different outlook, maintaining a Buy rating and hiking the price target up to $18 from the original $17.

Coursera’s earnings featured a loss of $0.35 per share, which was actually $0.07 lower than analysts were looking for. Revenue of $142.18 million was about the only bright spot, as it beat expectations by $4.1 million and was also a 23.7% year-over-year boost. That mixed report only got worse when Coursera brought out the guidance, which was all less than analysts expected. Coursera looked to bring in between $136 million and $140 million, which faltered against the $143.28 million expected.

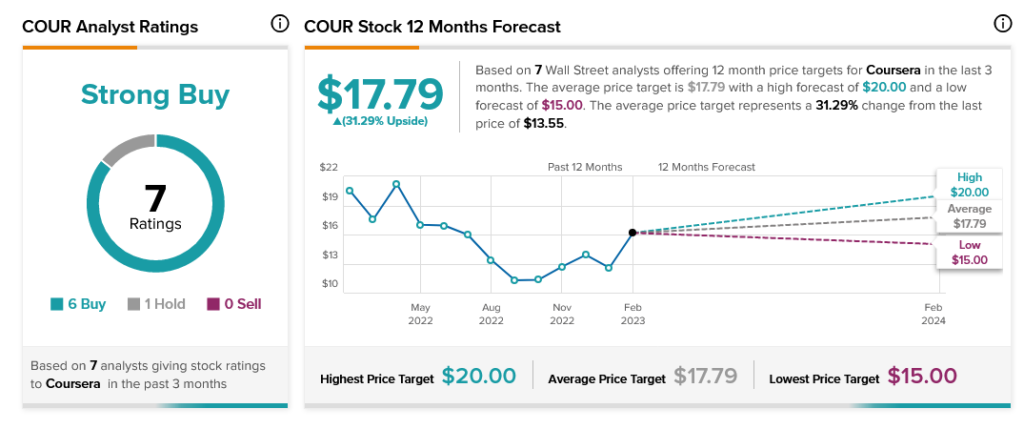

Overall, the bulk of analysts are actually on Coursera’s side. Indeed, analyst consensus calls it a Strong Buy. Further, thanks to its average price target of $17.79, Coursera stock comes with 31.29% upside potential.