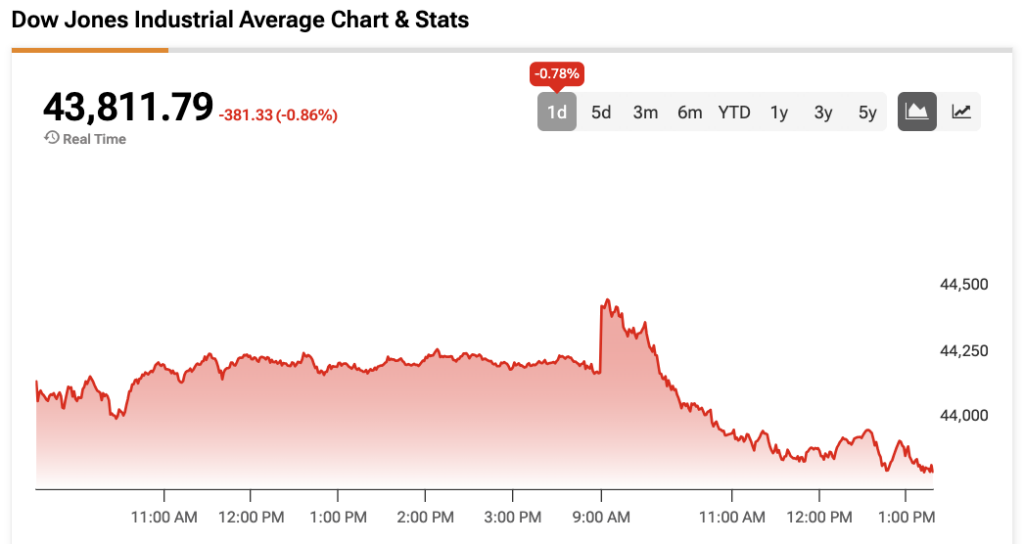

The Dow Jones (DJIA) opened Thursday’s trading session in the green but has since slipped into negative territory following a concerning jobs report.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Continuing jobless claims for the week ended July 26 totaled 1.974 million, above the estimate of 1.95 million and marking the highest amount since November 2021. Initial jobless claims for the week ended August 2 rose by 7,000 from the prior week to 226,000. That also came above the estimate for 221,000.

The labor market data points come after July’s nonfarm payrolls (NFP) report showed 73,000 new job additions, below the expectation for 104,000 additions. Making matters worse, May and June’s NFP numbers were revised downward by a combined 285,000 jobs, leading Trump to fire BLS Commissioner Dr. Erika McEntarfer.

Fed Chair Jerome Powell is set to step down once his term ends in May 2026, although the race to find his replacement is already in full swing. Former Fed Governor Christopher Waller is now the leading contender to replace Powell with 35% odds, up from 12% yesterday, on prediction platform Polymarket. Waller’s odds surged after Bloomberg reported that President Trump’s advisers were impressed with his mindset of setting monetary policy based on forecasts instead of current data.

On Wednesday, Trump announced he had narrowed down his Fed candidate shortlist to four people. Based on Polymarket odds, the list likely includes Waller, National Economic Council Director Kevin Hassett, former Fed Governor Kevin Warsh, and former Trump economic adviser Judy Shelton.

The Dow Jones is down by 0.86% at the time of writing.

Which Stocks are Moving the Dow Jones?

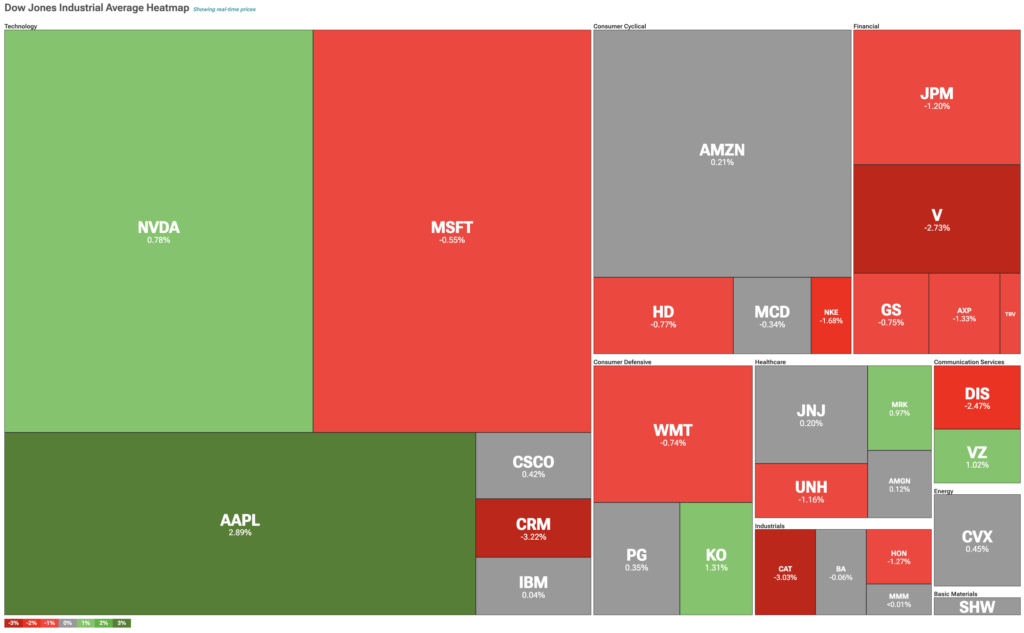

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Apple (AAPL) is the top-performing tech stock within the index after President Trump announced a $100 billion domestic investment from the iPhone maker on Wednesday. Apple is now set to invest $600 billion in the U.S. during the next four years.

On the other hand is Visa (V), which is leading all financial stocks to the downside. In fact, all five of the financial stocks in the Dow Jones are in negative territory.

Caterpillar (CAT) is also taking a tumble following its disappointing earnings report earlier this week. This morning, Morgan Stanley downgraded CAT stock to “Sell” from “Hold” while raising its price target to $350 from $283. The raised target still signals downside of about 16% from current prices.

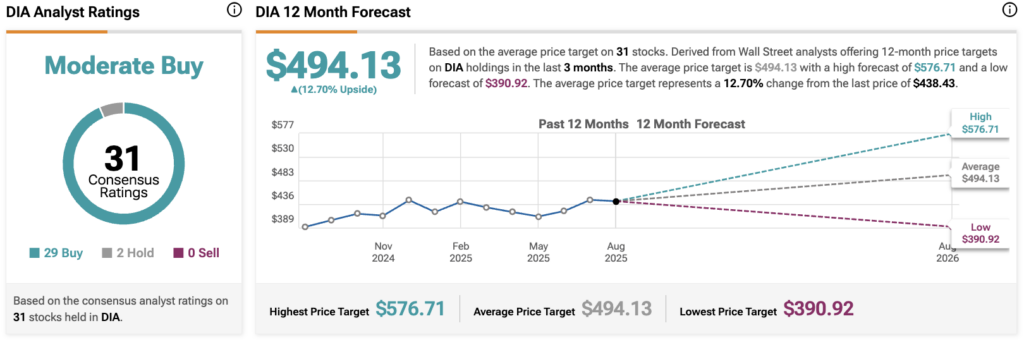

DIA Stock Moves Lower with the Dow Jones

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is falling alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $494.13, implying upside of 12.70% from current prices. The 31 stocks in DIA carry 29 buy ratings, 2 hold ratings, and zero sell ratings.