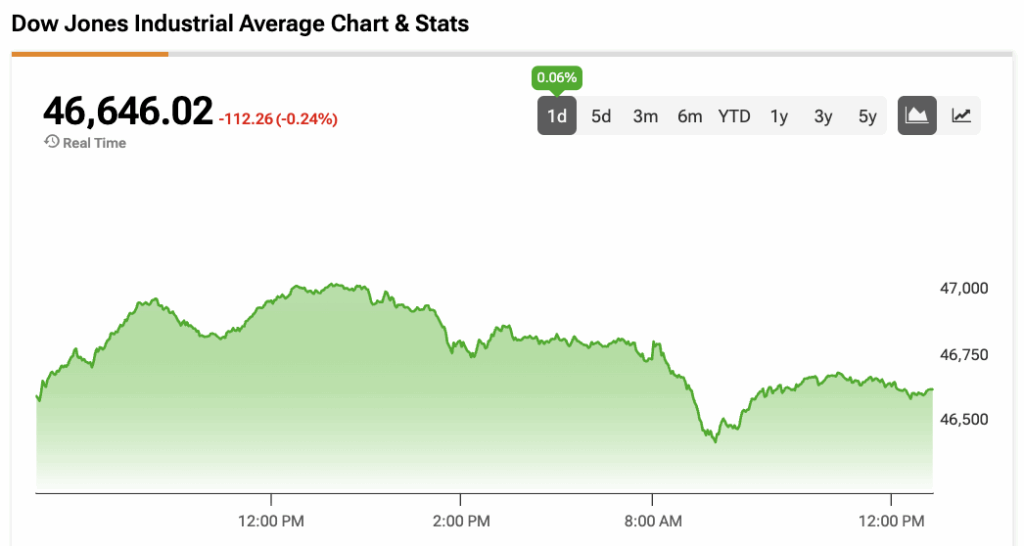

The Dow Jones (DJIA) is trading slightly lower as the government shutdown stretches into its sixth day.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

White House National Economic Council Director Kevin Hassett has warned that President Trump would begin laying off federal workers if congressional discussions to reopen the government “are absolutely going nowhere.” Even so, Hassett signaled optimism in an interview with CNN, adding “We think the Democrats, there’s a chance that they’ll be reasonable once they get back into town on Monday.”

The Senate will vote on a Democrat-backed bill to end the federal closure at 5:30 p.m. Eastern Time today. If the bill fails to pass, the Senate could then vote on a Republican stopgap bill that would extend government funding for seven weeks. The major disagreement between the two parties is an extension of Affordable Care Act subsidies, with Democrats backing the measure.

The odds of the shutdown extending to between 10 and 29 days are at 66% on prediction platform Polymarket. The odds of the shutdown lasting longer than 30 days are at 31%.

The stock market has largely brushed off the shutdown, with both the Dow Jones and the S&P 500 (SPX) up by about 1% during the past week.

“JUST OUT: Good news for the Holiday Season. EARLY PRICES ARE DOWN, WHILE TARIFFS ARE MAKING OUR COUNTRY AN ECONOMIC POWER AGAIN,” Trump said in a Truth Social post. “Also, virtually NO INFLATION, AS STOCK MARKETS CONTINUALLY HIT RECORD HIGHS.”

The Dow Jones is down by 0.24% at the time of writing.

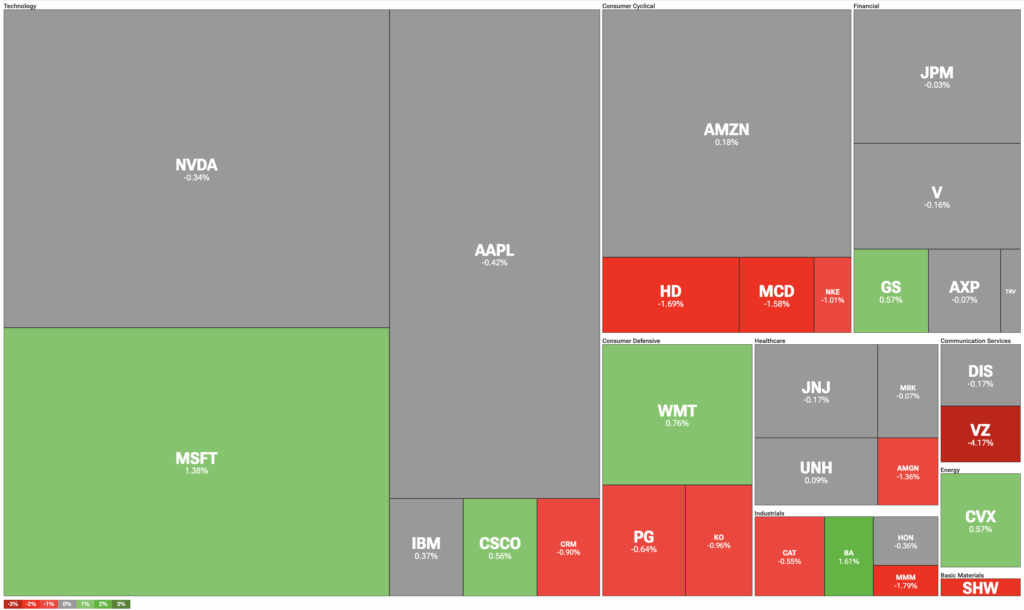

Which Stocks are Moving the Dow Jones?

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Nvidia (NVDA) is trading slightly lower after OpenAI announced that it would take up to 10% stake in semiconductor competitor Advanced Micro Devices (AMD) contingent on satisfying milestones. Under the terms of the deal, OpenAI will deploy 6 gigawatts of AMD GPUs over several years, with the first gigawatt to be deployed during the second half of 2026.

Amgen (AMGN) is leading all healthcare stocks to the downside after announcing U.S. direct-to-consumer sales for its cholesterol medication Repatha at a 60% discount. Earlier this year, Trump warned drug companies of higher tariffs if they failed to offer most-favored-nation (MFN) prices to U.S. buyers.

Elsewhere, Verizon (VZ) is slipping after the company named Dan Schulman as its new CEO, effective immediately.

DIA Stock Moves Lower with the Dow Jones

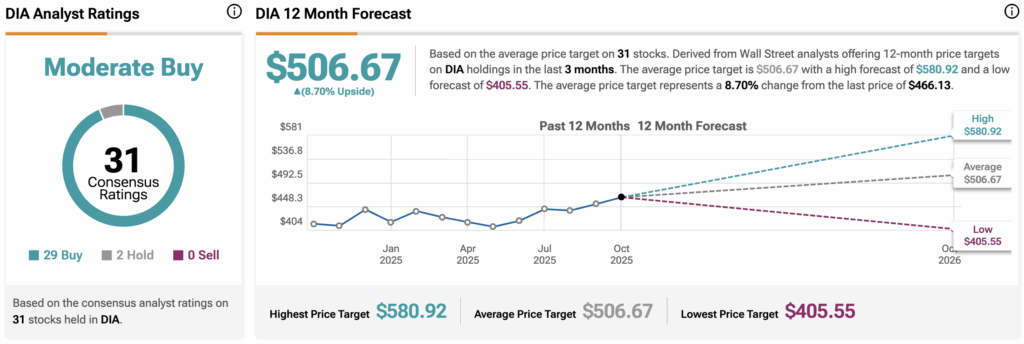

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is falling alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $506.67, implying upside of 8.70% from current prices. The 31 holdings in DIA carry 29 buy ratings, two hold ratings, and zero sell ratings.

Stay ahead of macro events with our up-to-the-minute Economic Calendar — filter by impact, country, and more.