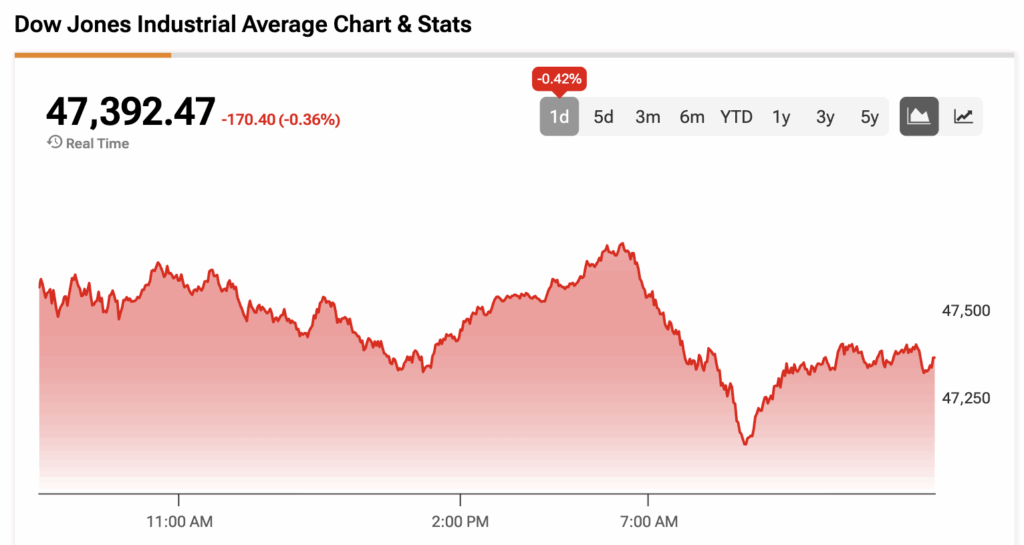

The Dow Jones (DJIA) opened Monday’s trading session in positive territory but has since reversed its gains following a disappointing October Institute for Supply Management (ISM) U.S. Manufacturing Index reading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The index fell by 0.4 points month-over-month to 48.7, below the estimate of 49.1 and marking the eighth consecutive month of contraction. A reading above 50 signals expansion, while a reading below 50 signals contraction. Respondents of the index still remain uneasy about the economic landscape due to changing tariff policies, with one saying, “Business continues to remain difficult, as customers are cancelling and reducing orders due to uncertainty in the global economic environment and regarding the ever-changing tariff landscape.”

At the same time, ISM points out that the U.S. economy expanded for the 66th consecutive month, as signaled by sustained Manufacturing Index readings over 42.3.

Meanwhile, President Trump has warned that the U.S. would be “defenseless” without tariffs ahead of a Supreme Court case on Wednesday to decide the legality of the taxes.

“If a President is not allowed to use Tariffs, we will be at a major disadvantage against all other Countries throughout the World, especially the ‘Majors.’ In a true sense, we would be defenseless!” Trump said in a Truth Social post. He added that stocks have reached record highs with “virtually No inflation” during his second term.

Finally, Fed Governor Stephen Miran reiterated his view that interest rates are too restrictive after warning last week that they could potentially lead to a recession. “The Fed is too restrictive, neutral is quite a ways below where current policy is,” Miran said in an interview with Bloomberg on Monday.

The Dow Jones is down by 0.36% at the time of writing.

Which Stocks are Moving the Dow Jones?

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Nvidia (NVDA) is leading the tech sector higher following news that Amazon (AMZN) will supply OpenAI with Nvidia GPUs through Amazon Web Services in a $38 billion deal. In addition, Loop Capital raised its NVDA stock price target to $350 from $250 and expects the company to double its GPU shipments to 2.1 million by early 2026. AMZN stock also received a price target boost, with Wedbush raising its estimate to $340 from $330.

Meanwhile, Apple (AAPL) is trading lower, despite Jefferies releasing a note expressing strong demand for the iPhone 17 base model.

Elsewhere, all stocks in the consumer defensive and healthcare sectors are in the red, dragging down the Dow Jones in the process.

DIA Stock Moves Lower with the Dow Jones

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is falling alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $528.57, implying upside of 11.67% from current prices. The 31 holdings in DIA carry 29 buy ratings, two hold ratings, and zero sell ratings.

Stay ahead of macro events with our up-to-the-minute Economic Calendar — filter by impact, country, and more.