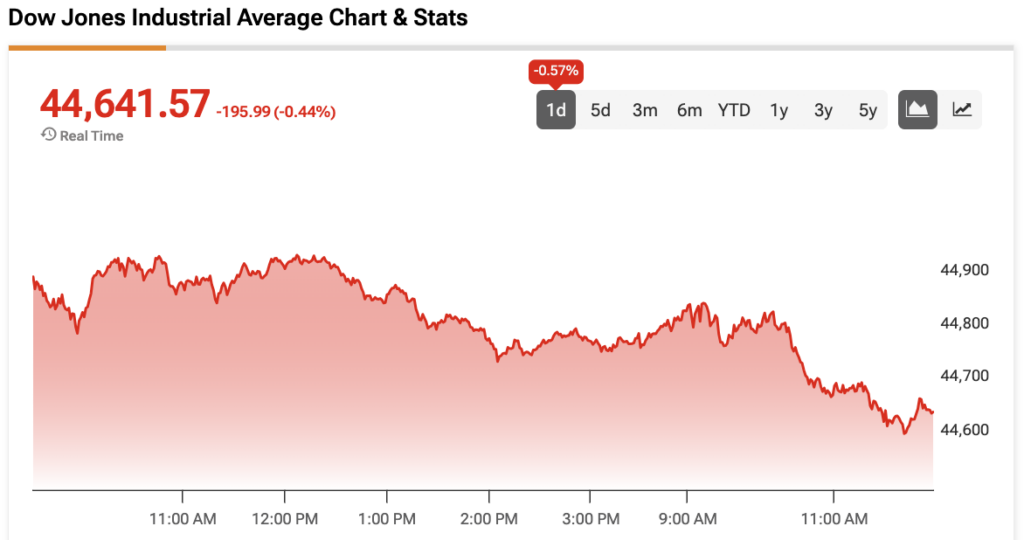

The Dow Jones (DJIA) is drifting further from its all-time high following a weaker-than-expected jobs report that offset a strong Consumer Confidence Index (CCI) reading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

July’s CCI rose by 2.0 points month-over-month to 97.0, above the expectation for 96.0. “Consumer confidence has stabilized since May, rebounding from April’s plunge, but remains below last year’s heady levels,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board. In addition, the average 12-month inflation outlook fell to 5.8% from 5.9%, although rising prices and inflation remain a concern among consumers.

At the end of June, there were 7.437 million job openings in the U.S., less than the 7.500 million expected and falling from 7.712 million during the previous month. Hiring also took a tumble, totaling 5.2 million and falling from 5.47 million in May. The hiring rate is at 3.3%, the lowest since November 2024.

Finally, all eyes are on the Fed’s interest rate decision tomorrow. The central bank is widely expected to maintain rates in a range between 4.25% and 4.50%. CME’s FedWatch tool assigns a 3.1% chance for a 25-bps rate cut.

The Dow Jones is down by 0.44% at the time of writing.

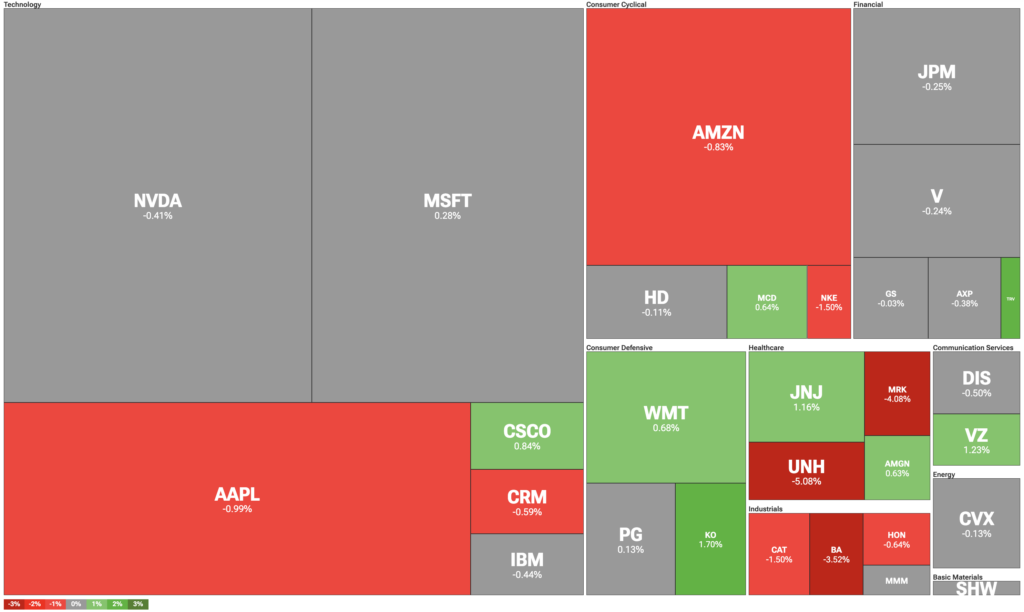

Which Stocks are Moving the Dow Jones?

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

UnitedHealth Group (UNH) is once again deep in the red after the healthcare company released disappointing 2025 guidance amid a Department of Justice investigation over its Medicare billing practices. Merck (MRK) is falling as well after the company reduced its guidance alongside a weak second-quarter revenue figure.

Aircraft maker Boeing (BA) is also plunging after reporting earnings. While its revenue came in above expectations, the company still operates at a loss and continues to face criticism related to the Air India crash.

DIA Stock Moves Lower with the Dow Jones

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is falling alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $488.13, implying upside of 9.39% from current prices. The 31 stocks in DIA carry 29 buy ratings, 2 hold ratings, and zero sell ratings.