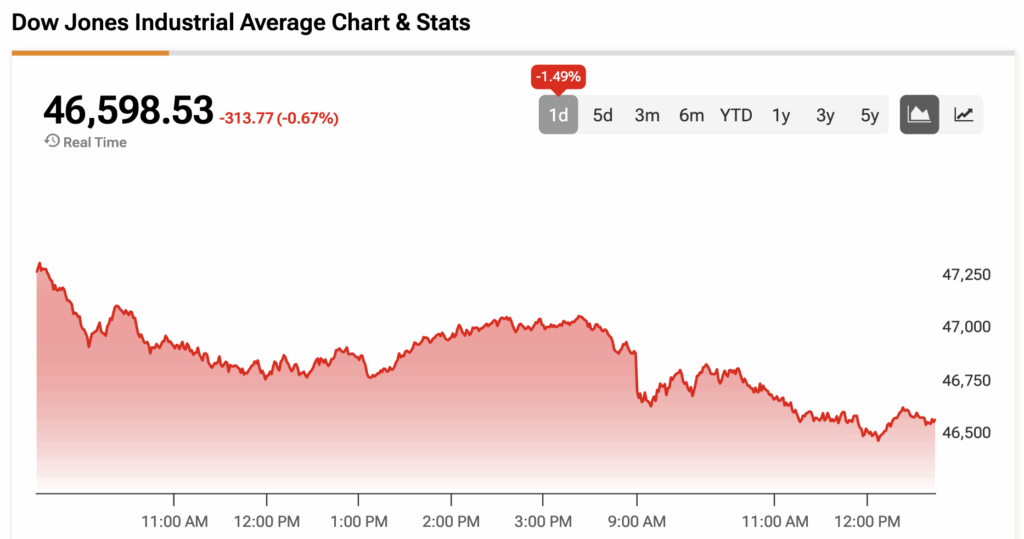

The Dow Jones (DJIA) is on track to end the week down by over 2% as AI stocks continue to lead the way lower amid the 38th day of the government shutdown.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The eight largest AI-related stocks, which include Nvidia (NVDA), Meta Platforms (META), and Oracle (ORCL), have erased over $900 billion in value since last Friday and are on track for their worst week since President Trump’s “Liberation Day” in April, according to the Financial Times. NVDA stock, which accounts for 2.39% of the Dow Jones, is responsible for about $430 billion of the losses.

Consumer sentiment, as measured by the University of Michigan, dropped to 50.3 in November amid the prolonged shutdown, the lowest level since the record low of 50.0 in June 2022. Surveys of Consumers Director Joanne Hsu added that the shutdown has begun to affect sentiment amid Supplemental Nutrition Assistance Program (SNAP) benefits and air travel disruptions in recent days.

“Consumer sentiment fell back about 6% this November, led by a 17% drop in current personal finances and a 11% decline in year-ahead expected business conditions,” said Hsu.

Elsewhere, Trump celebrated the news that Rep. Nancy Pelosi would retire and step down from her post upon the expiration of her term in January 2027. Pelosi’s stock portfolio has grown by 855% since May 2014, outpacing the S&P 500’s (SPX) return of 256%, according to Quiver Quant.

“She illegally made a fortune in the Stock Market, ripped off the American Public, and was a disaster for America,” he said in a Truth Social post on Friday. “I’m glad to see the stench of Nancy Pelosi go!!!”

The Dow Jones is down by 0.67% at the time of writing.

Which Stocks are Moving the Dow Jones?

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Nvidia (NVDA) is leading the tech sector to the downside as the AI selloff deepens, bringing its weekly loss to 12%. However, all three stocks in the consumer defensive sector are trading higher, highlighted by Coca-Cola’s 2% gain. The lone energy stock in the index, Chevron (CVX), is also in the green on rising oil futures.

Elsewhere, UnitedHealth Group (UNH) is on track to close in the red for eight consecutive trading sessions, with shares of the company down by about 13% during the past month. Furthermore, industrial stocks are contributing to the Dow Jones’ fall, with three of the four stocks trading in negative territory.

DIA Stock Moves Lower with the Dow Jones

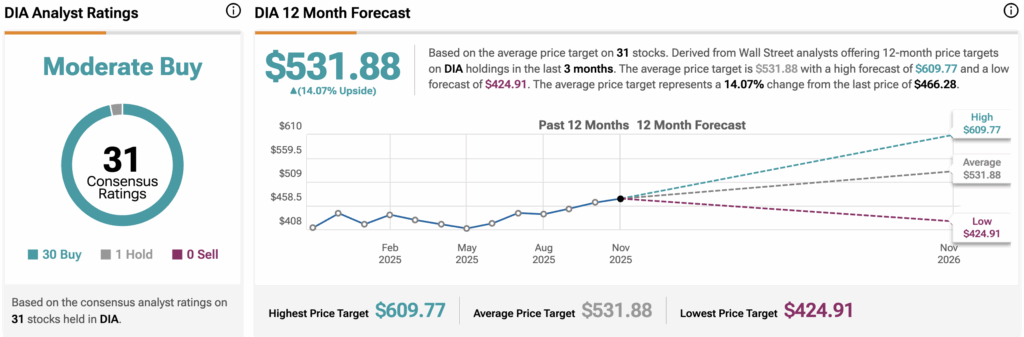

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is falling alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $531.88, implying upside of 14.07% from current prices. The 31 holdings in DIA carry 30 buy ratings, one hold rating, and zero sell ratings.

Stay ahead of macro events with our up-to-the-minute Economic Calendar — filter by impact, country, and more.