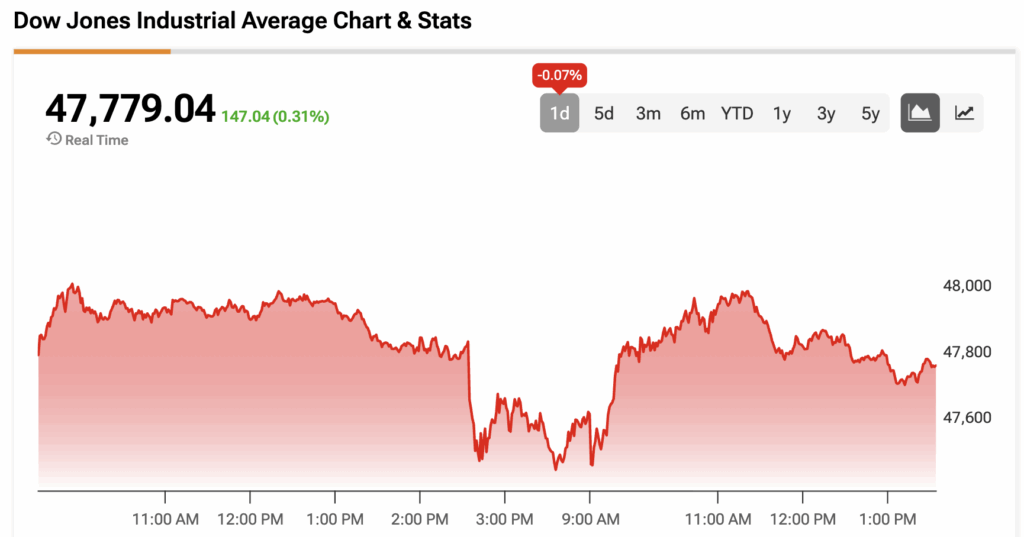

The Dow Jones (DJIA) has erased its morning losses and is now trading in the green following a meeting between President Trump and Chinese President Xi Jinping.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The meeting resulted in a one-year trade truce between the two countries, which includes the U.S. lowering its overall tariff on China to 47% from 57%. In addition, China has agreed to boost its purchases of U.S. soybeans and halt rare earth export restrictions.

“I had a truly great meeting with President Xi of China,” Trump said in a Truth Social post. “There is enormous respect between our two Countries, and that will only be enhanced with what just took place.”

Furthermore, Trump has ordered the Pentagon “to start testing our Nuclear Weapons on an equal basis” in order to match China’s and Russia’s pace of nuclear developments. It isn’t clear whether Trump is referring to tests of nuclear weapons or their delivery systems. Nuclear testing has been placed on pause in the U.S. since 1992, although the country can resume it at its discretion. The announcement comes after Russia ramped up testing of nuclear systems.

Meanwhile, the odds of a 25 bps rate cut at the December Federal Open Market Committee (FOMC) meeting slid after Fed Chair Jerome Powell noted that another rate cut by year-end wasn’t a “forgone conclusion.” The odds sit at 72.8% compared to a high of 98.78% on October 20.

The Dow Jones is up by 0.31% at the time of writing.

Which Stocks are Moving the Dow Jones?

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Big tech is taking a hit, with Nvidia (NVDA) and Microsoft (MSFT) both deep in the red. Concerns over excessive AI spending have gripped the market, with Microsoft saying in its earnings report that its 2026 capex spend would top its 2025 figure. Meanwhile, Amazon (AMZN) is also trading lower ahead of its earnings after the closing bell today.

Meanwhile, all five financial stocks are trading higher, led by Goldman Sachs (GS). These stocks generally benefit from higher interest rates due to a higher net interest margin, or the difference between what they charge borrowers and what they pay depositors.

Elsewhere, Disney (DIS) is in the green after finalizing an agreement to acquire a majority stake in FuboTV (FUBO).

DIA Stock Moves Higher with the Dow Jones

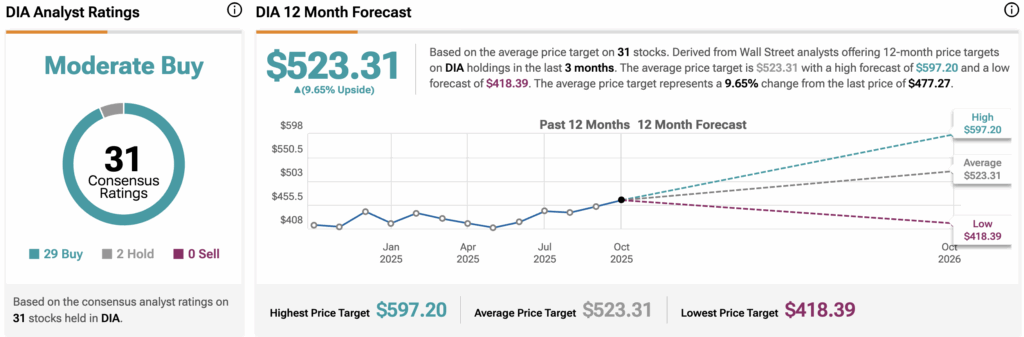

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is rising alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $523.31, implying upside of 9.64% from current prices. The 31 holdings in DIA carry 29 buy ratings, two hold ratings, and zero sell ratings.

Stay ahead of macro events with our up-to-the-minute Economic Calendar — filter by impact, country, and more.