The Dow Jones (DJIA) is essentially unchanged on Thursday as the government shutdown enters its second day.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

President Trump is considering “thousands” of federal layoffs and is actively reviewing workforce reductions in several areas amid the shutdown, said White House press secretary Karoline Leavitt. In addition, Trump will meet with Office of Management and Budget (OMB) Director Russ Vought to discuss cuts to programs run by Democrats and whether they will be permanent or temporary.

“I can’t believe the Radical Left Democrats gave me this unprecedented opportunity,” Trump said in a Truth Social post.

That comes amid Challenger, Gray & Christmas reporting that September’s planned job cuts fell by 37% month-over-month to 54,064. At the same time, the year-to-date total of 946,426 is still the highest since 2020. The Department of Government Efficiency (DOGE) has been responsible for most of the cuts, said the outplacement firm.

“With rate cuts on the way, we may see some stabilizing in the job market in the fourth quarter, but other factors could keep employers planning layoffs or holding off hiring,” said Challenger, Gray & Christmas senior vice president Andy Challenger.

Meanwhile, Treasury Secretary Scott Bessent said that the U.S. and China could achieve a “big breakthrough” during the next round of in-person trade talks. Bessent is set to meet with Chinese Vice Premier He Lifeng at the APEC (Asia-Pacific Economic Cooperation) Summit in South Korea, while Trump will meet with Chinese President Xi Jinping.

The Dow Jones is down by 0.08% at the time of writing.

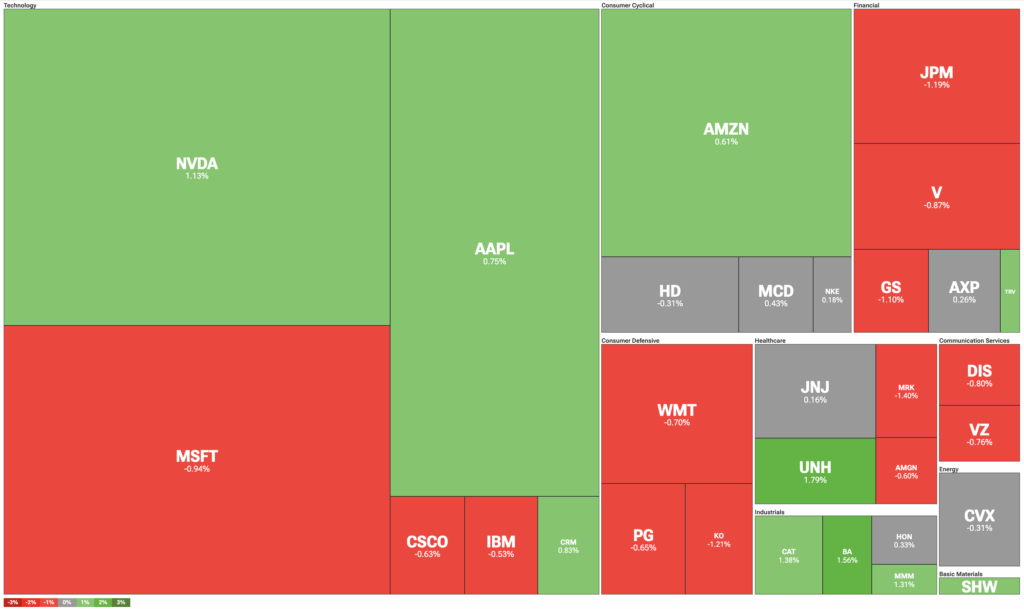

Which Stocks are Moving the Dow Jones?

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Nvidia (NVDA) is leading all tech stocks to the upside and secured a new all-time high of $191.05. Shares of the semiconductor leader are up by 11% during the past month. Industrial stocks are another bright spot, with Boeing (BA) leading the way. Earlier this week, the Wall Street Journal reported that Boeing is in the process of developing a new plane to succeed the 737 MAX.

Elsewhere, most Dow Jones components are trading in the -1% to +1% range. UnitedHealth Group (UNH) is continuing its blistering rally, up by nearly 50% since August, while all three consumer defensive stocks are in negative territory.

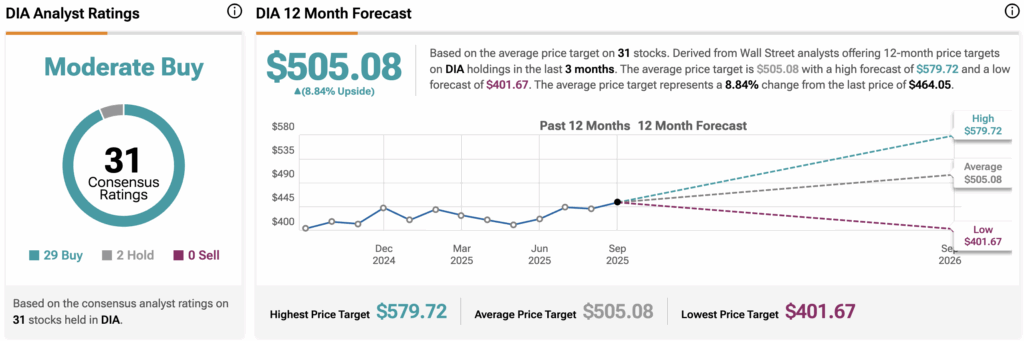

DIA Stock Moves Lower with the Dow Jones

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is falling alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $505.08, implying upside of 8.84% from current prices. The 31 holdings in DIA carry 29 buy ratings, two hold ratings, and zero sell ratings.

Stay ahead of macro events with our up-to-the-minute Economic Calendar — filter by impact, country, and more.