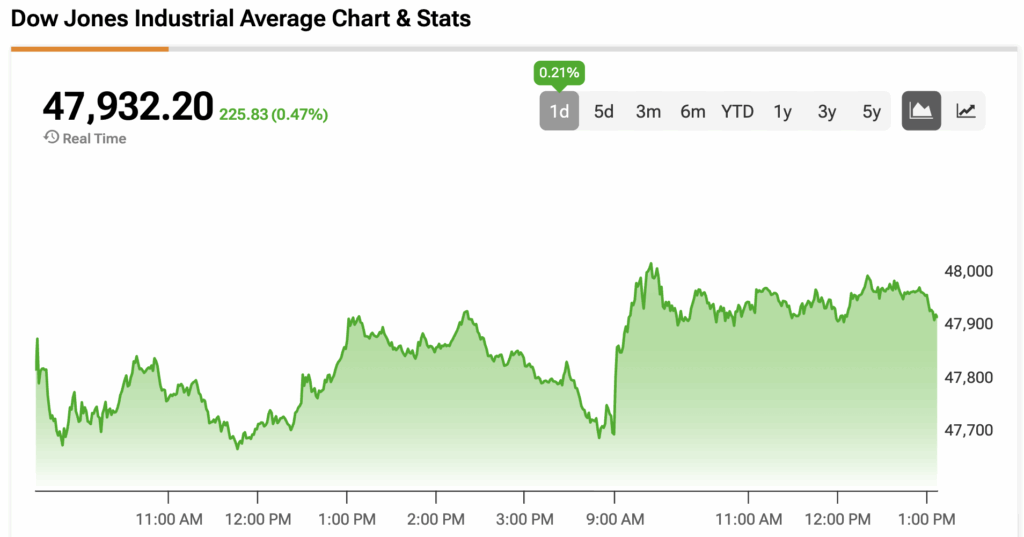

The Dow Jones (DJIA) secured a new all-time high of 48,040.64 on Wednesday ahead of the Fed interest rate decision.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The central bank is expected to cut rates by 25 bps for a second time this year to a range of 3.75%-4.00%. That comes as federal inflation and labor data used by the Fed remain delayed as a result of the government shutdown, which is now in its 29th day.

“In the absence of the official data for jobs, they’re going to lean on other sources of information, which at this point aren’t really going to contradict what they have argued as their reason for cutting,” said former Fed official Esther George in an interview with Yahoo Finance.

Ahead of the decision, President Trump is in South Korea for the Asia-Pacific Economic Cooperation (APEC) Summit, which begins on October 31. This morning, Trump announced a trade deal between the U.S. and South Korea that will see Washington lower its tariffs on South Korean autos to 15% from 25%. In return, South Korea has committed to investing $350 billion in the U.S. $200 billion of the investment will be in cash, limited to $20 billion per year. Another $150 billion will be invested in a shipbuilding deal.

A U.S.-China trade deal could be announced next, with Trump teasing that the two sides will be able to sign a “great deal.” Trump’s stance on Beijing has eased after he threatened to hike its tariff rate by 100% earlier this month, causing panic across the market.

“We’re going to be, I hope, making a deal. I think we’re going to have a deal. I think it will be a good deal for both,” Trump said on Wednesday. Trump will meet with Chinese President Xi Jinping at 11 a.m. Eastern Time on Thursday.

The Dow Jones is up by 0.47% at the time of writing.

Which Stocks are Moving the Dow Jones?

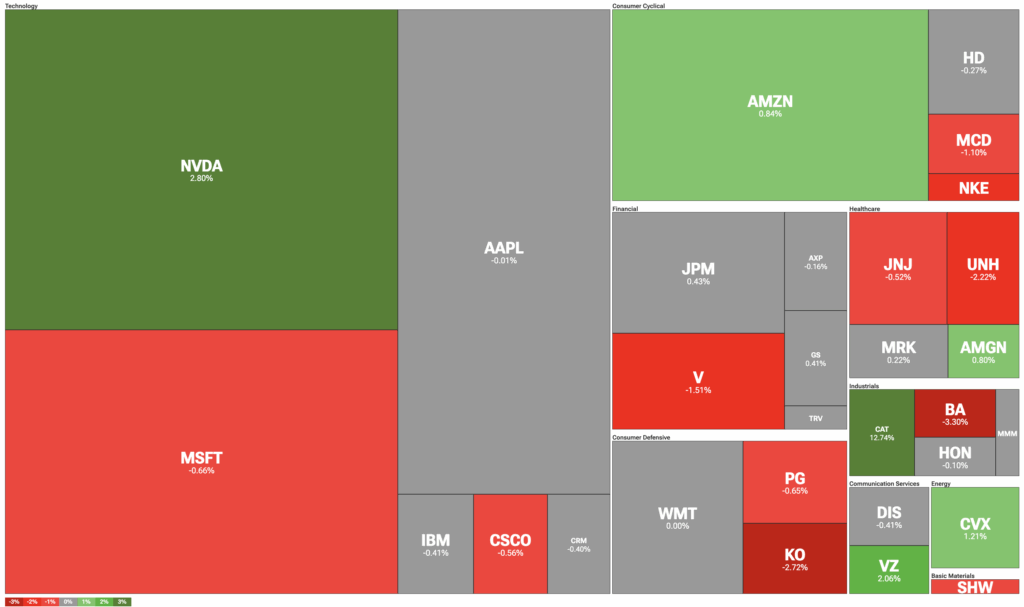

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Nvidia (NVDA) secured a new record high of $212.19 and became the first company to reach a $5 trillion valuation. The semiconductor leader also received a price target hike to $275 from $235 from Bank of America. Other tech stocks, like Microsoft (MSFT) and Cisco (CSCO), are slightly in the red.

Caterpillar (CAT) is the top performer in the Dow Jones after the equipment manufacturer reported its earnings, beating on both revenue and adjusted EPS. In addition, CAT stock clinched a new all-time high of $596.21.

Elsewhere, Boeing (BA) is trading lower after its third-quarter earnings showed a $4.9 billion charge due to its delayed 777X wide-body aircraft, while Chevron (CVX) is getting a boost from rising oil futures.

DIA Stock Moves Higher with the Dow Jones

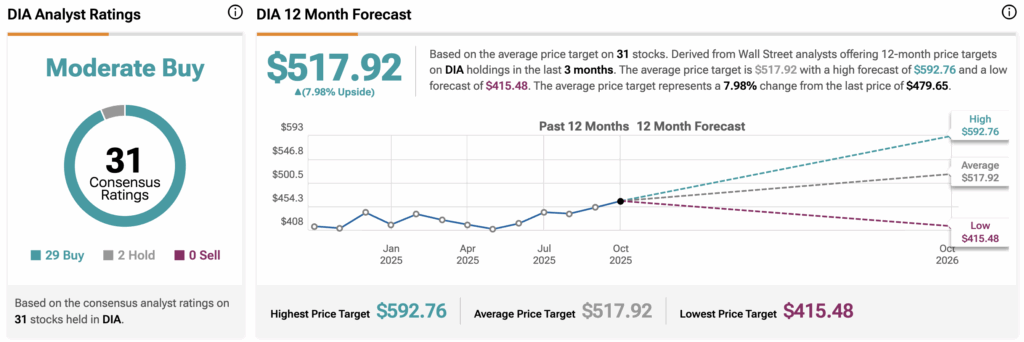

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is rising alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $517.92, implying upside of 7.98% from current prices. The 31 holdings in DIA carry 29 buy ratings, two hold ratings, and zero sell ratings.

Stay ahead of macro events with our up-to-the-minute Economic Calendar — filter by impact, country, and more.