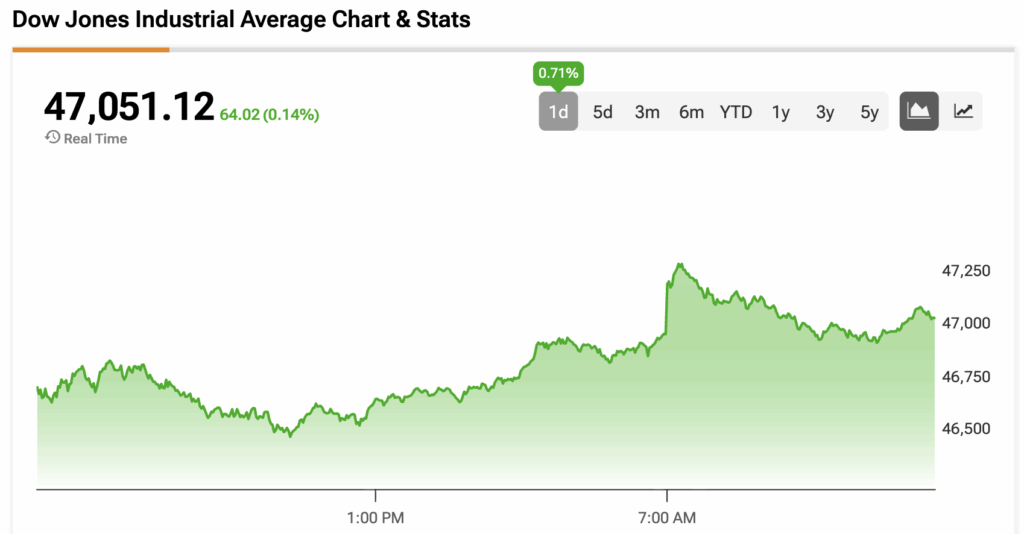

The Dow Jones (DJIA) is trading higher but has given up most of its early morning gains on the 41st day of the government shutdown.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

On Sunday, the Senate advanced a bill that would extend government funding until January 30, 2026, in a 60-40 vote, although the chamber has yet to fully approve the bill. Speaker Mike Johnson has already called on the House to convene in Washington, D.C., for a vote that is expected later this week.

“We’re going to get everybody back on a 36-hour notice, so it’ll be happening early this week,” Johnson said on Monday. If the House approves the measure, President Trump would need to provide his stamp of approval before the government reopens.

The shutdown has halted the release of key inflation and labor data from federal agencies, although private firms have continued to release their own metrics. According to OpenBrand, U.S. consumer durables and personal goods inflation was 0.22% in October, marking the first deceleration in three months.

Finally, Trump floated the idea of providing Americans in low- and middle-income classes with a $2,000 tariff dividend check. “A dividend of at least $2000 a person (not including high income people!) will be paid to everyone,” Trump said in a Truth Social post. He didn’t specify what would qualify a person as high-income, although previous stimulus checks sent out during his first term limited the payments to individuals with an annual income of over $75,000 and couples with an annual income of over $150,000.

The Dow Jones is up by 0.14% at the time of writing.

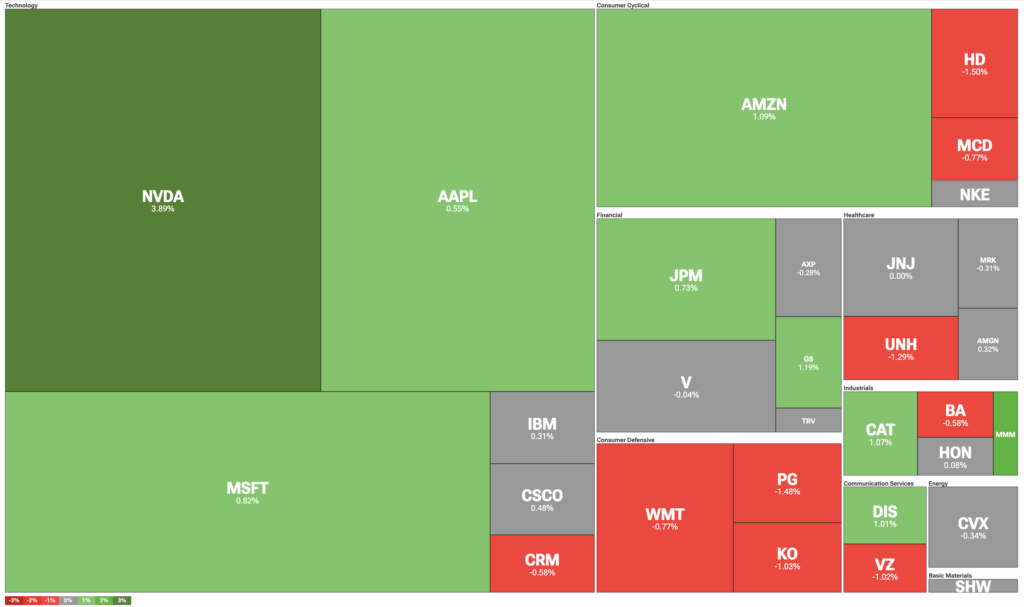

Which Stocks are Moving the Dow Jones?

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Nvidia (NVDA) is leading the tech sector after analysts at several Wall Street firms issued bullish notes on the semiconductor company ahead of its earnings report on November 19. Wolfe Research expects Nvidia to generate $300 billion in chip revenue in 2026 and around $8 per share in EPS, while Citi Research reiterated its “buy” rating.

Meanwhile, Visa (V) is trading slightly lower after the payment processor proposed lowering its merchant swipe fee by an average of 0.1% over the next five years in an attempt to settle a legal dispute that has stretched for two decades.

Elsewhere, all three consumer defensive stocks are trading in negative territory, while Magnificent 7 member Amazon (AMZN) is up by about 1%.

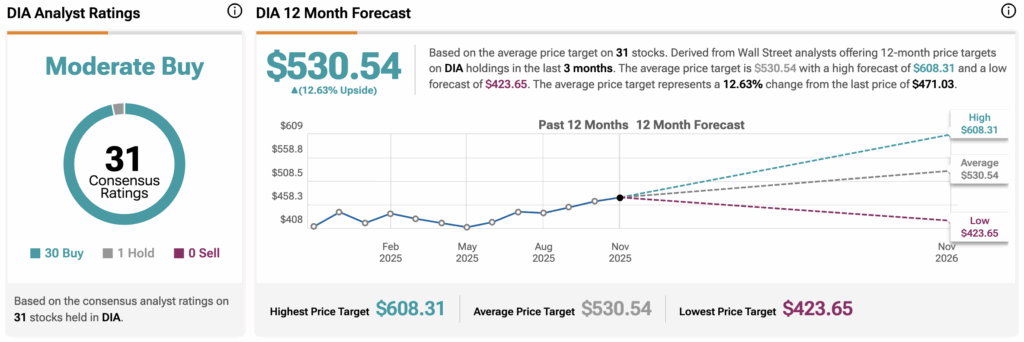

DIA Stock Moves Higher with the Dow Jones

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is rising alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $530.54, implying upside of 12.63% from current prices. The 31 holdings in DIA carry 30 buy ratings, one hold rating, and zero sell ratings.

Stay ahead of macro events with our up-to-the-minute Economic Calendar — filter by impact, country, and more.