The Dow Jones Industrial Average (DJIA) continues to drop today as an escalating trade war occupies investors’ minds. The big news affecting the index on Tuesday is President Donald Trump placing an additional 25% tariff on steel and aluminum imports from Canada. This brings the total tariff on these metals to 50%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

President Trump introduced the new metal tariffs on Canada after Ontario added a 25% energy surcharge to U.S. homes and businesses. Ontario warned it may further increase this energy surcharge or completely cut off energy to the U.S. The President stated that Canada is a “tariff abuser” and that Americans don’t need cars, lumber, or energy from the country.

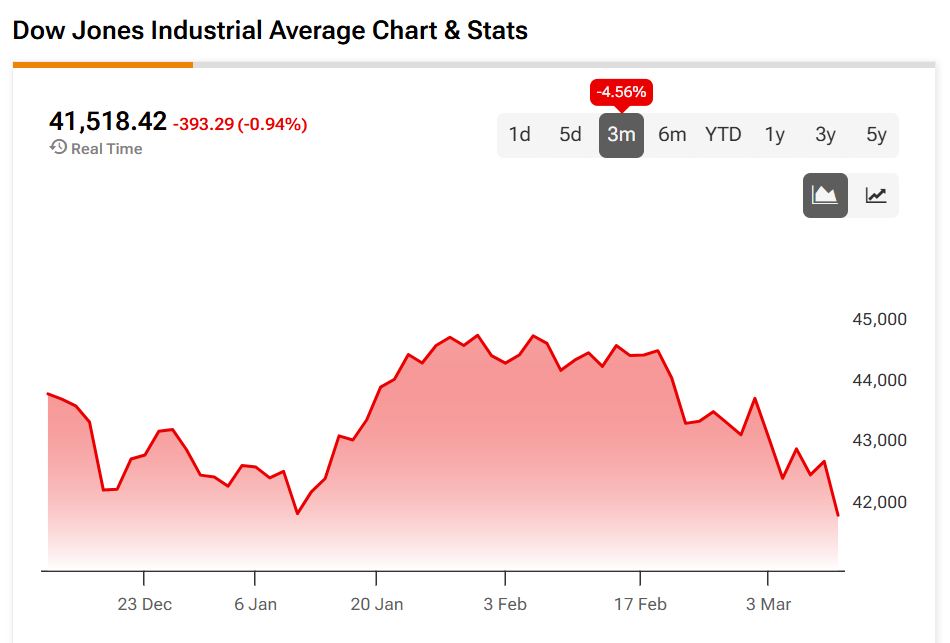

The DJIA isn’t doing so hot today following news of the escalating trade war. This has the index down 0.94% this morning, building on a 4.56% drop over the last three months and a year-to-date decrease of 1.49%.

Which Stocks Hit the DJIA Index Today?

Turning to the TipRanks DJIA heatmap tool, traders will see which stocks are dragging down the index today. There’s plenty of red to be seen on the heatmap as the trade war pulls stocks lower on Tuesday. Leading these drops are Apple (AAPL), McDonald’s (MCD), International Business Machines (IBM), Chevron (CVX), and Visa (V).

How to Invest in the DJIA Index

Investors can’t take a direct stake in the Dow Jones as it’s only an index. Instead, they might consider buying shares listed on it. Risk-averse traders might stick with resilient stocks, while traders with hardened nerves could buy stocks falling today in hopes of a rebound.

Another option is buying shares of an exchange-traded fund (ETF) that tracks the DJIA. There are options for ETFs that bet on or against the index. The SPDR Dow Jones Industrial Average ETF Trust (DIA) is one popular choice in favor of the index.