Intel (NASDAQ:INTC) stock got rocked earlier this week when company management revealed, first, that it plans to break out the numbers separately for its growing chips foundry business going forward – and then proceeded to reveal just how badly this business has performed in the past. In 2023, Intel revealed that it lost $7 billion building semiconductor chips for its rivals at the foundry division – 35% worse losses than the division incurred in 2022, and with sales down 31% year over year.

Commenting on the news, Bernstein analyst Stacy Rasgon noted that Intel has finally brought the “awful” troubles of its foundry division to the “forefront” in investors’ minds. And as a result, faced with the “huge surprise” of just how much Intel’s foundry is costing the company, investors sold off Intel stock for an 8% loss on Wednesday, and closed the week down 12%.

The situation, though, is even worse than that.

As Rasgon pointed out, 2023 wasn’t the worst year Intel will have for foundries. Despite trying to cut costs last year, this division is still struggling with negative 37% operating margins, and “things are still getting worse in 2024.”

Hearing this, investors naturally wonder when things will get better? And unfortunately, the answer to that is probably: not soon.

Not too long ago, Intel had told investors to expect the foundries business to be earning 60% gross profit margins and 40% operating profit margins by 2026. But this week, the company updated those expectations… by pushing off to 2030 its prediction that foundry gross profit margins might range from 35% to 40%, and operating profit margins might range from 25% to 30%. Both these ranges, you may notice, fall well below what the company had previously promised to generate in 2026.

Similarly, Rasgon noted that the 18A and 14A architecture that Intel was supposed to have ready for producing AI chips by 2025, will now probably not reach production scale “until well into the latter half of the decade.” And taken in conjunction with the pushed-back projections for the foundry business, Rasgon seems to detect a theme in Intel’s prognostications:

Simply put, Intel has developed a habit of making optimistic promises, only to see those expectations dashed, and to beat a hasty retreat when reality intrudes. This pattern of conduct has surprised disheartened the company’s investors, but for his part, Rasgon isn’t surprised. As the analyst rhetorically asks: “It took 10 years to get Intel into their current position. Why would it take any less time to fix it?”

And if that’s the case, and if it will take Intel until 2030 or so to (maybe) deliver on its promises, then the analyst makes the quite reasonable conclusion that there’s “no real reason to be here [i.e. for investors to buy Intel stock] until 2030,” when Intel has a more reasonable chance of delivering on its promises.

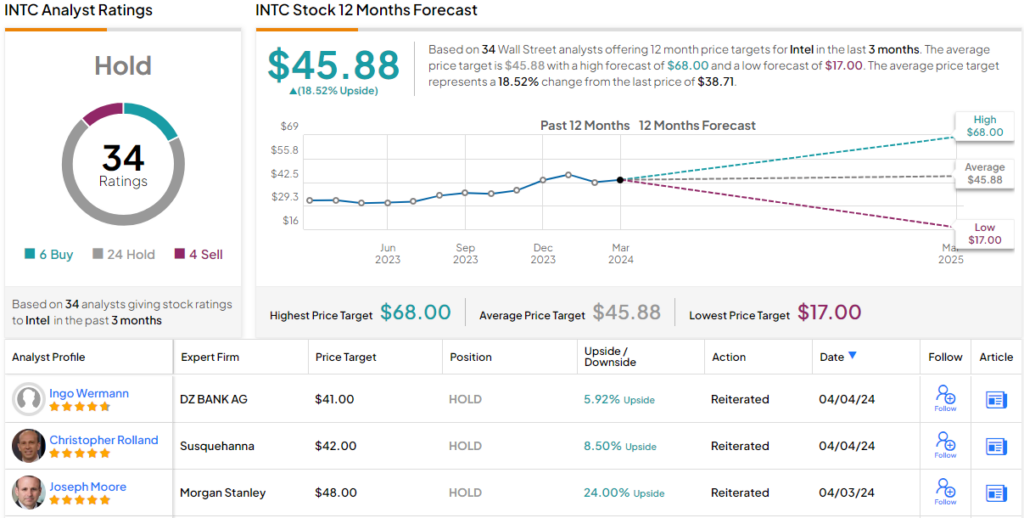

In the meantime, Rasgon hangs a $42 price target on Intel stock – and even though that’s a modest 8.5% improvement over Intel’s $38.71 closing price on Friday – the analyst rates the stock only a Market Perform (i.e. Neutral). (To watch Rasgon’s track record, click here)

Overall, Wall Street appears to agree with Rasgon that caution is required here. The analyst consensus on this stock is a Hold, based on 34 ratings that include 6 Buys, 24 Holds, and 4 Sells. However, the average price target of $48.88 implies an 18.5% upside from current levels. (See INTC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.