There has been no doubt about the quality of Lucid Group’s (NASDAQ:LCID) Lucid Air; its electric luxury sedan has garnered plenty of compliments since arriving on the EV scene in 2021.

However, despite the vehicle’s impressive reception, the steep price point, coupled with a slowdown in EV demand, has presented significant hurdles for the company. Furthermore, the substantial costs associated with bringing the vehicle to market have strained Lucid’s financial resources, and the company has had issues ramping production.

The result has been a stock that is down by more than a woeful 95% since the peaks of November 2021 and has shed 42% in 2024 alone.

In assessing Lucid’s prospects, Citigroup analyst Itay Michaeli weighs the company’s “strong EV tech position & adequate near-term liquidity” against historical demand and branding hurdles, resulting in a perceived “balanced risk/reward.”

In assessing Lucid’s prospects, Citi analyst Itay Michaeli weighs the company’s “strong EV tech position & adequate near-term liquidity” against historical demand and branding hurdles, resulting in a perceived “balanced risk/reward.”

For a successful next page to unfold in the Lucid story, much now rests on a successful ramping of its upcoming Gravity SUV, a critical launch that will take place later this year.

Having spent some time reviewing the vehicle, Michaeli came away encouraged by the Gravity and sees “good prospects” for success. Nevertheless, there remains considerable “execution risk” around a successful on-schedule launch for the car. Additionally, Michaeli hopes the Gravity will debut with the “most affordable trims in order to drive volume and generate commercial momentum,” even if it means sacrificing some initial profit margins.

As per the company’s guide and the current Q1 numbers (the company expects to produce around 9,000 vehicles this year and delivered 1,967 vehicles during Q1), Michaeli expects 9,100 deliveries in 2024. The analyst is calling for a 2024E adj.-EBITDA loss of $2 billion and anticipates the company will reach breakeven in 2027E.

“Over the near-term,” Michaeli summed up, “we expect the shares to trade range-bound until the Gravity launch comes into clearer view.”

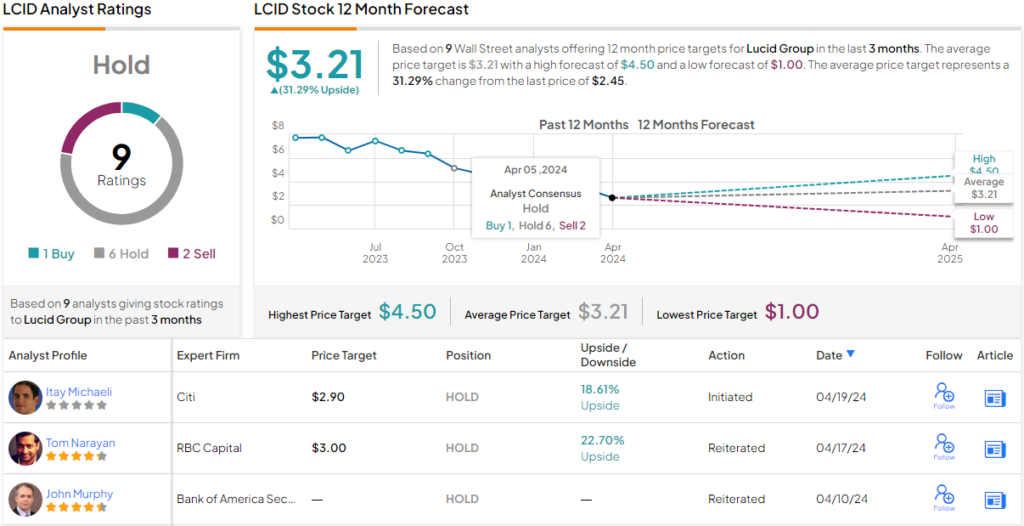

To this end, Michaeli rates LCID stock a Neutral, along with a $2.90 target, which implies ~19% upside from current levels. (To watch Michaeli’s track record, click here)

On the whole, Michaeli’s Wall Street colleagues offer a similar take; based on a mix of 6 Holds, 2 Sells, and 1 Buy, the analyst consensus rates this stock a Hold. Most also think the shares are somewhat undervalued by now; at $3.21, the average target represents 12-month upside of 31%. (See LCID stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.