Is Intel (NASDAQ:INTC) stock back? If you ask Bank of America analyst Vivek Arya that question, he’s likely to respond with a resounding “maybe.”

On Wednesday, Intel investors got a huge confidence boost when the U.S. Department of Commerce awarded Intel $8.5 billion in subsidies from its 2022 Chips Act funds, to help Intel pay the cost of building some new factories, and expanding others, in the states of Arizona, New Mexico, Ohio, and Oregon. Fully 16% of the money’s allocated to Chips Act subsidies, it seems are going to go to just one semiconductor company, and that company is Intel.

And yet, Arya still isn’t 100% convinced this is enough to make Intel stock a “buy.”

In his latest research note on INTC, Arya described how he hosted Intel CFO David Zinser and IR head John Pitzer at an investor dinner. At that dinner, Intel expressed confidence that it will grow its sales both quarter over quarter and year over year in every single quarter of 2024 — and grow even faster in the year’s back half.

How will Intel do this? And how will it keep on growing after 2024 is ended?

Seasonality in PC shipments appears to be part of the answer. Arya writes that as Windows 10 operating systems wind down and PC users transition to Windows 11, there will be growth in sales of artificial intelligence-enabled personal computers (i.e. computers with AI built right into the machine, rather than hosted on some company’s server farm). In the very near term, this won’t be visible in Q2, which is usually “seasonally flattish” for the PC market. However, as we move into the second half of this year, Intel feels “especially confident” of a recovery in PC demand.

Intel is also hoping to see growth in sales to corporations (i.e. “enterprises”) looking to “expand into generative AI.” Intel expects that not all of these customers will want to use AI provided by other companies in the cloud, but rather possess some AI capability of their own. While Arya (or perhaps Intel itself) wasn’t 100% clear on how this will work, he notes that “INTC with its strong enterprise data center incumbency, attractive server CPU pipeline, and strong OEM partnerships is well positioned to capture this growing opportunity.”

Yet another lever Intel might pull to accelerate growth is a nascent foundry business building “18A” chips for other chips companies hiring Intel to build and package their products. Arya notes that Intel promised to give more detail on this and other non-core businesses in a “webinar” scheduled to take place on April 2. Arya expects Intel to provide longer-term targets for growth at that webinar.

In the meantime, however, and despite Intel’s obvious enthusiasm for its own business, Arya continues to sit on the sidelines on Intel stock. Citing tough competition from Nvidia, AMD, and Taiwan Semiconductor, the analyst declined to upgrade Intel stock from his current Neutral rating, and left his price target unchanged at $50 per share. (To watch Arya’s track record, click here)

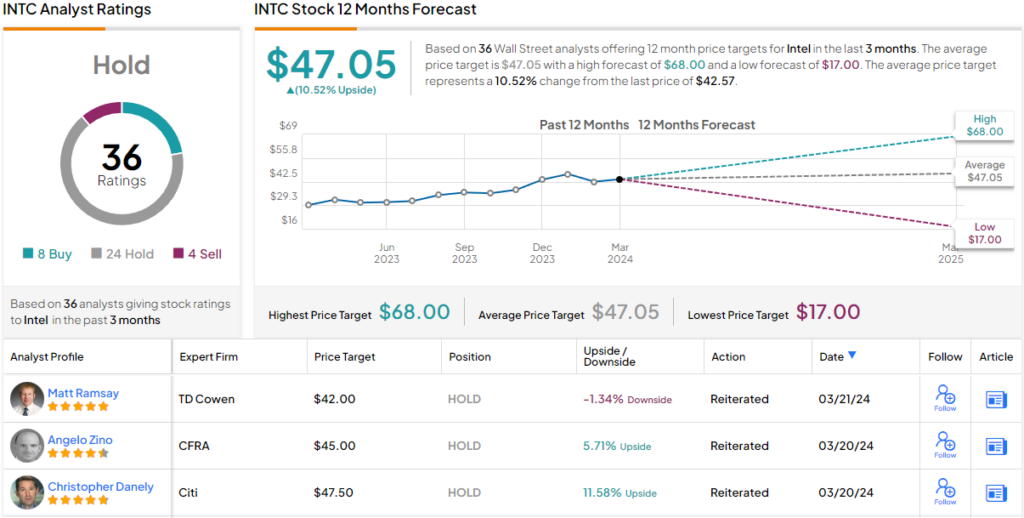

Wall Street absolutely echoes Arya’s tone of caution on INTC, with TipRanks analytics exhibiting the stock as a Hold. Out of 36 analysts polled in the last 3 months, 24 remain sidelined, 8 say Buy, while 4 suggest Sell. With a return potential of 10.5%, the stock’s consensus target price stands at $47.05. (See INTC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.