Getting consumers to purchase EVs is proving more difficult than initially expected as demand has softened and concerns around affordability remain.

Looking at the case of EV maker Rivian (NASDAQ:RIVN), according to UBS’s 2024 Global EV survey results, there’s growing awareness of the brand amongst potential BEV (battery electric vehicle) buyers. That said, while those interested in the BEV market are increasingly aware of Rivian, UBS analyst Joseph Spak notes that, at 10%, overall awareness remains low although that has increased from ~7% last year. Furthermore, only 4.5% suggested they would mull over buying a Rivian EV, slightly above last year’s 3.8%. In total, Spak reckons Rivian’s 2023 US BEV share (ex-vans) stood at ~2.9%.

The survey shows that consumers may want more EV choices and alternatives, which taken at face value, should be good news for Rivian. “However,” says Spak, “overall US interest for EVs has stagnated, particularly given the lack of affordable options.” Rivian’s R1S SUV’s pricing starts at $74,900 while its R1T pickup starts at $69,900. That does not compare well to the average price of a car in the U.S., which currently stands at $47,200. Meanwhile, after significant price discounts, the average BEV costs $52,300.

Another potential problem for Rivian revolves around consumers’ interest in PHEVs (plug-in hybrid electric vehicles). “We believe PHEV technology may prove to be a good solution for larger vehicles. To the extent competitors come out with large SUV/pickup PHEV options, that could be a headwind for RIVN’s R1 vehicles,” Spak opined.

This is the point at which Rivian’s more affordable R2 and R3 vehicles become “critical to the equity story.” The starting price of the R2 is expected to be a “more reasonable” $45,000. The problem with that, however, is that the vehicle’s production is only slated to begin in 2026.

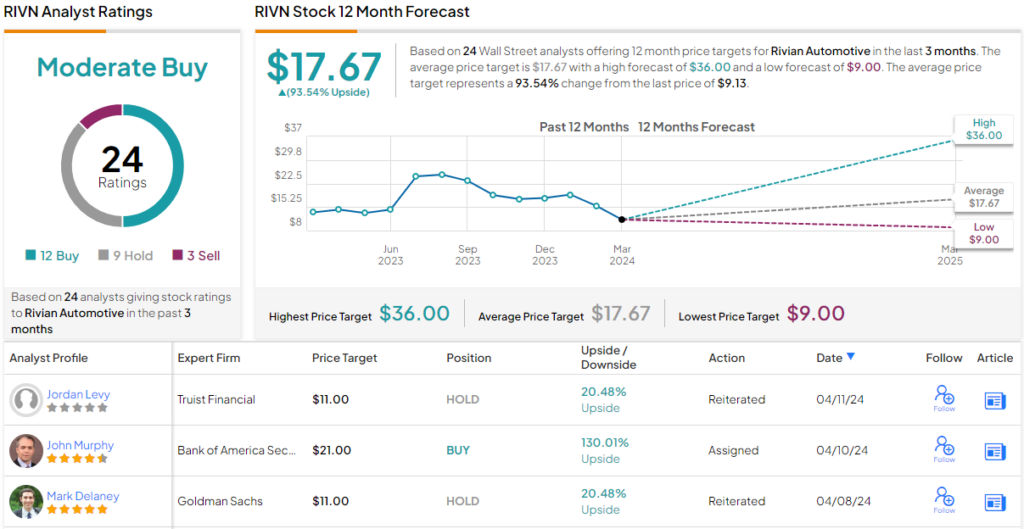

Bottom-line, given that the R2 launch is more than ~2 years away, while Spak also believes 2025-27 consensus delivery forecasts are “overly optimistic,” he rates RIVN shares a Sell, along with a $9 price target. That figure suggests the shares will stay rangebound for the time being. (To watch Spak’s track record, click here)

The consensus view is generally more upbeat. The analysts rate RIVN a Moderate Buy, based on a mix of 12 Buy recommendations, 9 Holds and 3 Sells. Moreover, there are nice gains projected; at $17.67, the average target factors in one-year returns of 93%. (See Rivian stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.