Uber Technologies (UBER), the ride-hailing and delivery giant, has seen strong momentum this year, with its stock up more than 43% year-to-date. The company is expanding its user base and improving profits, thanks to solid sales growth and better cost control. On Tuesday, Stifel’s Top analyst, Mark Kelley, initiated coverage on the stock with a Buy rating and a $110 price target, pointing to his growing confidence in Uber’s shift toward becoming a versatile, all-in-one platform.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It’s worth noting that Kelly ranks 109 out of more than 9,627 analysts tracked by TipRanks. He has a success rate of 68%, with an average return per rating of 26.10% over a one-year timeframe.

Kelley Sees Uber as a “Super App”

The five-star analyst believes Uber has grown far beyond its roots as a ride-hailing service. In his view, the app is turning into a true “super app”—one that lets people book rides, order food, get groceries, and see ads along the way. He feels these services make Uber more useful for users and give the company more ways to grow.

Kelley is also upbeat about the company’s financial outlook. He thinks Uber is on track to meet its key goals and has already shown strong progress in areas like profit growth and free cash flow.

Looking ahead, the analyst sees more growth coming from “less dense/non-urban areas” and global markets. He believes that Uber One—the company’s monthly subscription plan—will help more users save and stay loyal to the platform. With this in mind, he expects bookings to grow by 16% in both 2025 and 2026. He also predicts profits will rise faster than sales, thanks to better control over costs.

Kelley is also confident in Uber’s food and grocery delivery segment. He sees big potential in less crowded areas, where ride-hailing may not be the main draw. He believes that growth in driver supply, along with Uber One, will help increase delivery orders over time.

Lastly, the analyst sees a strong future for Uber’s ad business. He points to the company’s wide user base and detailed location data as key strengths. According to the analyst, advertising could become a major source of revenue as the business scales up.

Is UBER a Good Stock to Buy?

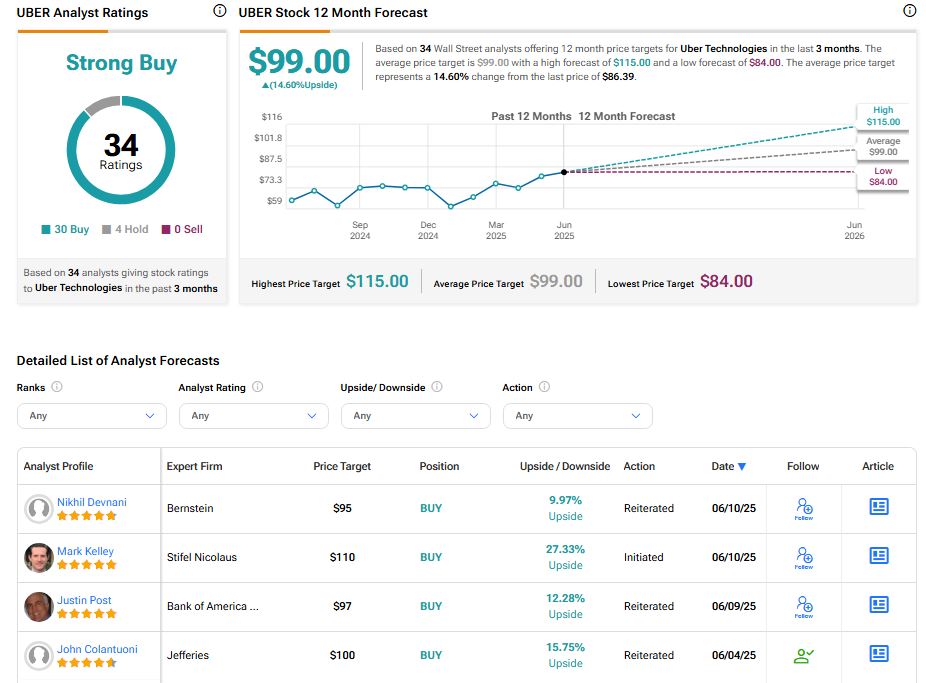

Overall, Wall Street has a Strong Buy consensus rating on UBER stock, based on 30 Buys and four Holds assigned in the last three months. The average Uber stock price target of $99 implies about 14.60% upside potential from current levels.