For most of the year so far, SoundHound AI (NASDAQ:SOUN) investors have been riding a wave of success, with the company’s stock emerging as one of the standout performers of the year. Investors have been drawn to the company’s expertise in voice recognition technology within the realm of AI. Furthermore, SoundHound AI’s credibility received a significant boost with an investment from Nvidia, the biggest name in AI.

However, more recently, the story appears to have soured somewhat, with the shares pulling back by 43% from the year’s peaks amidst a short report that claimed the company is “peddling lies and deception.”

While Cantor analyst Brett Knoblauch refrains from making such accusations, he does express doubts about SOUN’s current valuation.

“Given the infancy of SOUN’s business, opaqueness of its operating model, decelerating organic growth, lack of capex spend, loss of customers, and growing competition from big tech, we believe SOUN’s current valuation (35.7x/24.6x 2024E/2025E EV/Sales) is difficult to justify and see more downside risk than upside at current levels,” Knoblauch opined.

The shares’ parabolic move, says Knoblauch, does not relate to real world performance. The company is calling for revenue growth of ~50% in 2024, which suggests revenue of ~$69 million. That factors in the “inorganic contribution” of the SYNQ3 acquisition, which the analyst reckons adds more than $5 million of inorganic revenue in 2024E. “Thus,” Knoblauch goes on to say, “on an organic basis, we believe revenue growth will decelerate in 2024E relative to 2023.”

Knoblauch also touches upon a point made in the short report. Some of last year’s revenue haul was actually generated via customers that paid a one-time fee to “exit their relationship” with the company. SOUN has put that down as “contract modification” and incorporated the revenue into product royalties. As SOUN said this contract modification was with a German automotive company, Knoblauch thinks the client was Mercedes-Benz, with the analyst reckoning the auto giant wanted out of its contract so it could use OpenAI’s ChatGPT tech in its infotainment system, rather than keep using SOUN’s product.

Another worrying sign is the fact that insiders have been selling shares recently. While that is understandable, the volume is a concern. “If we were in their shoes, and shares just went from sub $2 to $9, we would likely take some chips off the table, but we believe that the pace of sales increasing over the prior weeks is a sign that the recent run-up in shares has become overextended,” Knoblauch explained.

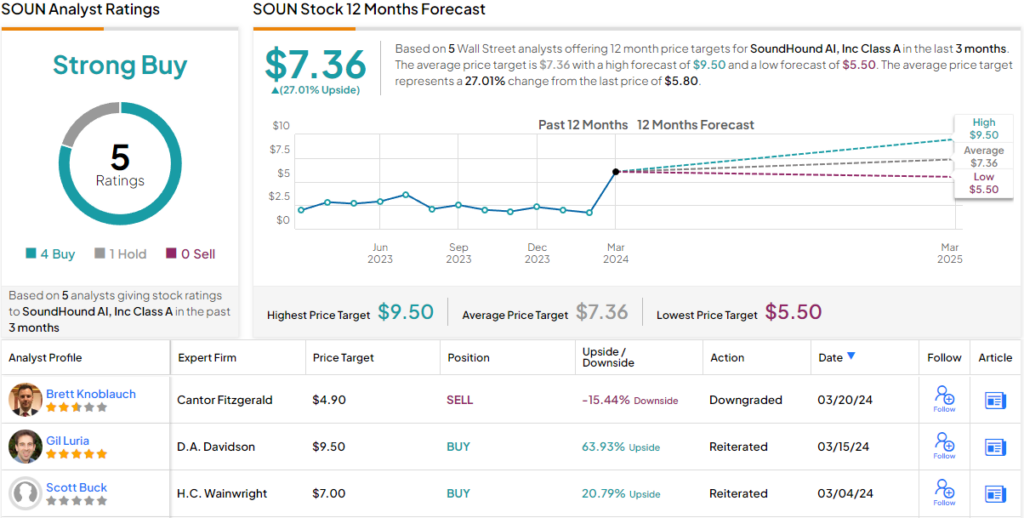

Bottom-line, Knoblauch thinks a double downgrade is due, and as such, he has lowered his rating on SOUN from Overweight (i.e., Buy) to Underweight (i.e., Sell). His price target also goes down from $5.80 to $4.90, implying the shares are now overvalued by ~15%. (To watch Knoblauch’s track record, click here)

That said, Knoblauch is alone in his bearish take here. 4 other analysts rate SOUN shares a Buy and another recommends a Hold, all adding up to a Moderate Buy consensus rating. Going by the $7.36 average target, a year from now, shares will be changing hands for a 27% premium. (See SOUN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.