It’s now more than 3 years since GameStop (NYSE:GME) went on its historical surge, spearheading the meme stock mania with the story now part of Wall Street folklore. For any investors still hoping for something of an unlikely repeat, the chances got even slimmer following the struggling video retailer’s latest quarterly update.

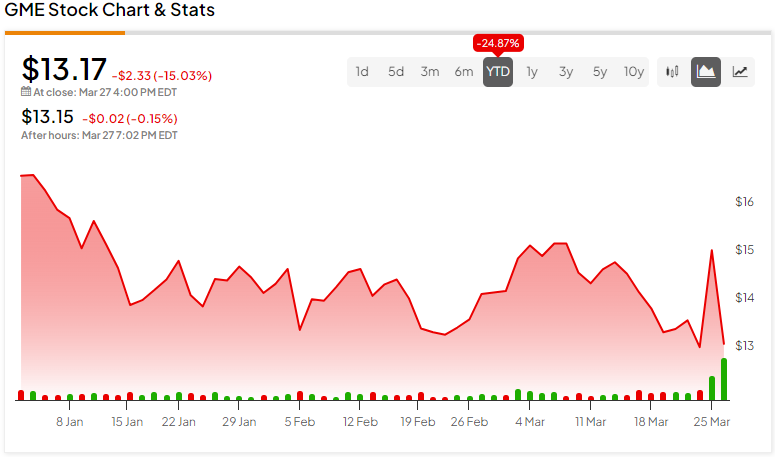

Shares tumbled 15% in Wednesday’s trading session after the company missed on both the top-and bottom-line in its fiscal fourth quarter earnings report (which ended February 3).

Partly down to weaker video game industry sales trends, the continued mix shift to digital distribution, and possibly losing share against other retailers and e-commerce platforms, revenue fell by 19.7% year-over-year to $1.79 billion, falling shy of the Street’s forecast by $260 million.

On the plus side, seeing the benefits of cost optimizations and reduced freight expenses, gross margin rose 100bps vs 4Q22 to 23.4%. SG&A saw a meaningful 21% drop compared to the same period a year ago, as the company persists in closing stores and cutting costs, including reducing expenses related to staffing, advertising, marketing, but still accounted for 20% of revenues, roughly the same as the same period a year ago. At the bottom-line, adj. EPS of $0.22 came in $0.07 below the consensus estimate.

Assessing the print, Baird’s Colin Sebastian, a 5-star analyst rated in the top 4% of the Street’s stock pros, thinks the company is in a precarious position, although he lays out a path forward, even as GameStop’s intentions remain opaque.

“GameStop’s disappointing Q4 results underscore ongoing challenges to the company’s retail business model,” the 5-star analyst said. “Moreover, we have limited confidence in the company’s ability to restore growth and drive further operating efficiency; however, we believe a smaller store footprint with a modernized consumer experience could eventually find an equilibrium point. We expect bulls would point to new hardware and expected release of GTA 6 next year as upcoming catalysts. However, with management providing limited information and with ongoing business model concerns, we cannot recommend buying the stock at these levels.” (To watch Sebastian’s track record, click here)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.