In what represented one of the U.S. semis industry’s largest public-private investments ever, last week it was announced that through the CHIPS Act, Intel (NASDAQ:INTC) is set to receive an $8.5 billion grant for fab development across its sites in Arizona, New Mexico, Ohio, and Oregon, along with potential access to $11 billion in loans. Moreover, the chip giant intends to leverage the investment tax credit from the U.S. Treasury Department, which is anticipated to reimburse up to 25% of qualifying investments exceeding $100 billion over a span of five years.

While not underestimating the importance of the additional funds, TD Cowen’s Matt Ramsay, an analyst ranked amongst the top 10 on Wall Street, does not consider them to be a game changer.

“While clearly any and all funding helps reduce net CapEx and improve the company’s free cash flow, we don’t view the announcement as materially impacting the stock thesis,” said Ramsay. “Recall, Intel’s CapEx plans had always included 20-30% in capital offsets from across CHIPS Act funding (from both the US and EU), customer commitments, and financial partners such as Brookfield Partners.”

Rather, it’s the imminent division of the P&L between the product business and the foundry, scheduled for April 2nd, that will have a more significant impact on the stock over the short-term. Additionally, long-term wise, the company’s success in executing its product roadmap will be crucial in helping to both “stem share loss” in the core datacenter CPU sector and establish a substantial presence in the AI accelerator market.

In general, Ramsey recognizes the “incredible progress” being made with Intel’s 5N4Y (5 nodes in 4 years) plan and he “leans positive” regarding its prospects for eventual success in their process roadmap.

“However,” the 5-star analyst goes on to say, “we remain of the view that this process node turnaround is a necessary but insufficient milestone towards regaining product leadership in key verticals such as server and AI. That being said, the long-term holds a ton of potential if execution improves.”

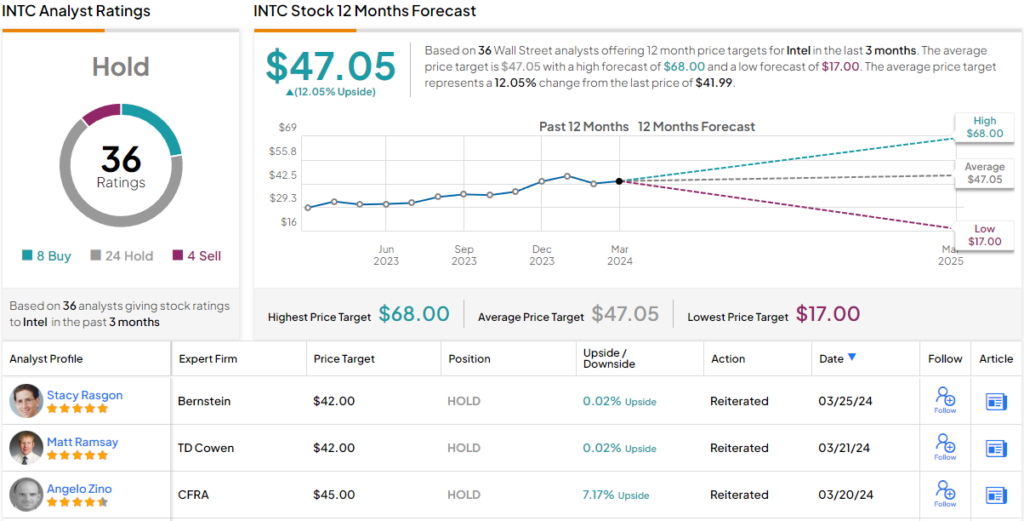

For now, Ramsey remains on the sidelines with a Market Perform (i.e., Neutral) rating and a $42 price target, suggesting the stock will remain rangebound for the time being. (To watch Ramsey’s track record, click here)

Most of Ramsey’s colleagues are also sitting on the fence for now. Based on a total of 24 Hold ratings, 8 Buys and 4 Sells, the stock claims a Hold consensus rating. The average price target stands at $47.05, implying the stock will gain 12% over the coming months. (See Intel stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.