Analysts at Goldman Sachs (GS) have a bold new call. The Wall Street investment bank says it doesn’t expect the U.S. Federal Reserve to lower interest rates until December of this year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The new outlook on interest rates from Goldman Sachs comes as the Fed concludes its latest policy meeting on June 18. The U.S. central bank is widely expected to keep interest rates at current levels, with futures traders placing the odds of a rate cut at only 0.2%.

Most of Wall Street doesn’t expect the U.S. central bank to resume cutting interest rates until September of this year, at the earliest. However, a growing number of economists and analysts say they don’t expect rates to be lowered until October. Goldman’s call for a first rate cut in December is an outlier among economists and analysts.

Economic Outlook

While the central bank is expected to stand pat on interest rates, it is also releasing its latest projections for the U.S. economy at the conclusion of its June 18 meeting. The updated outlook could move the stock market, depending on whether the Fed is dovish or hawkish on the American economy.

Economists say the biggest thing to watch coming out of the latest meeting will be whether the Fed sticks with its previous forecast of two interest rate cuts this year. Markets will also likely respond to any changes in the Fed’s outlook on inflation.

The U.S. Federal Reserve’s latest interest rate decision will be released at 2 p.m. Eastern time on June 18.

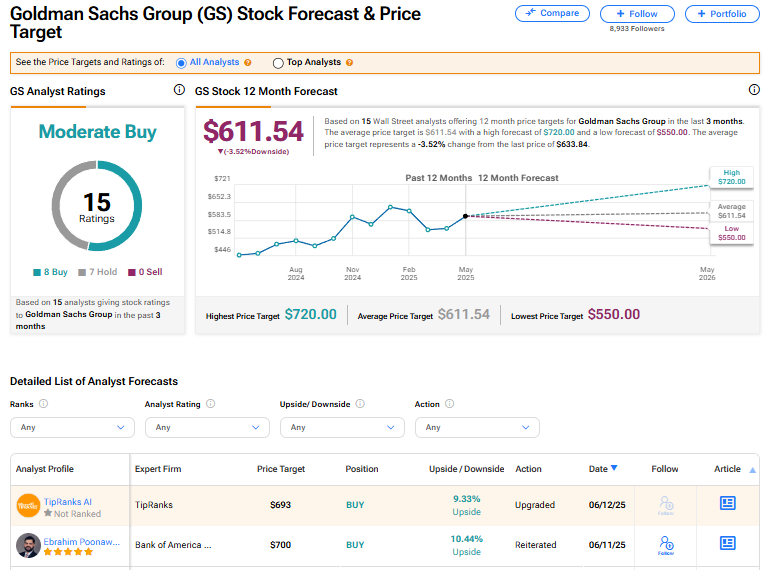

Is GS Stock a Buy?

Goldman Sachs stock has a consensus Moderate Buy rating among 15 Wall Street analysts. That rating is based on eight Buy and seven Hold recommendations assigned in the last three months. The average GS price target of $611.54 implies 3.52% downside from current levels.