Despite the broad bullish sentiment on Nike’s (NKE) stock, one bank is taking a far more cautious stance. In a note released this morning during the European trading session, UBS analyst Jay Sole reaffirmed his Hold rating and attached a restrained $71 price target — a stark contrast to the prevailing optimism — just 24 hours before Nike is set to release its earnings after tomorrow’s market close.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Heading into the earnings call, Nike’s stock has traded in a $52 to $85 range this year, though the overall drift has been downward. The silver lining for investors is that volatility appears to have settled near the low end, cushioning recent declines and keeping losses relatively contained.

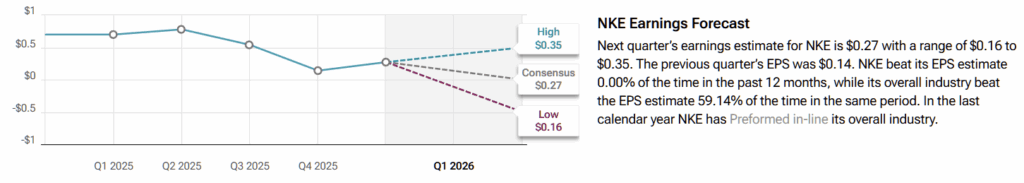

Wall Street expects earnings per share of $0.27 — a sharp decline from last year’s $0.70, though above the most recent quarterly print of $0.14. According to Nike, its “Win Now” initiative is expected to improve the disjointed business as part of a larger team alignment within the company, which is internally referred to as “the sport offense.”

As a reminder, under its action-focused CEO, Nike has unleashed an internal (yet still branded) initiative encompassing a progressive series of aggressive active changes aimed at kickstarting performance and resetting momentum across the firm.

Nike’s ‘Win Now’ Playbook Faces Its Critics

The key areas of focus have been identified as “driving distinction” within key sports, building a complete product portfolio, and “creating stories to inspire and connect with consumers.” Critics argue this is more of the same, only reworded. In other words, the suspicion is that Nike is simply reverting to its legacy playbook of searching out unique products it can monopolize, while expecting other brands not to emulate them—and finally, deploying marketing polyfilla to entice spending.

Recent results have been rather grim. Nike closed the previous financial year under pressure, with revenue sliding 10% for the year and fourth-quarter sales dropping 12%. Such sharp declines underscore the challenges facing the sportswear giant as it navigates shifting consumer demand and a brutal retail landscape flooded with high-quality apparel at lower cost than what Nike can manage.

Shareholders shouldn’t panic just yet, though. Nike still holds sway as the “premium” brand in apparel, with several leading innovations that enable it to dictate lofty prices with a straight face. However, more critical, and more nuanced, is the pressure on “value perception,” as consumers weigh up whether Nike’s higher price point justifies the product compared to alternatives.

It would seem that, lately, the company’s once-unshakable brand equity is being tested more directly than ever — forcing Nike not just to innovate in products, but to prove to a skeptical consumer base that its swoosh still carries a premium worth paying for. Meanwhile, shareholders may be slightly apprehensive about the recent decoupling from the S&P 500 (SPX).

With fresh results due, the spotlight is on whether Nike can steady the ship or if the latest numbers will point to more turbulence ahead.

Last time out, NKE’s CEO, Elliott Hill, confirmed that his suspicions about the apparel manufacturer’s slide were confirmed and that the results are “not where we want them to be.” This time around, investors will be looking not just for acknowledgment of the struggles, but for tangible signs that Nike’s internal streamlining is gaining traction.

Simply put, Nike needs to show that the bleeding has stopped and that real resilience is emerging in an increasingly fragmented market. Anything short of that risks deepening doubts that the turnaround is stuck in first gear. Should tomorrow’s results fall flat, the stock may, ironically, retrace the gap it carved out on June 27 — the very day Q4 numbers briefly reignited optimism with a surprise revenue beat — and fall to ~$62 per share.

Nike’s management faces the same uphill battle, but seasoned investors know that “just doing it” by scooping up shares at multiyear lows may be more reckless than bold. On this point, UBS’s caution may prove well-placed.