Nio (NYSE:NIO) isn’t exactly garnering much favor from investors lately, to say the least. The stock has been on a downward spiral since the start of 2021. Since then, it has plummeted by a staggering 93% from its peaks.

Now, it’s been well-telegraphed that the EV industry has been in a slump and while most still agree electric vehicles are set to became increasingly prevalent on the roads over the coming years, the adoption rate has been slower than anticipated. Meanwhile, while demand has softened, competition has become ever fiercer. That has been particularly true in the world’s biggest EV market, China, where Nio primarily operates.

Yet, with Nio stock having taken such a big beating, might it be time to take a chance and catch this falling knife? Absolutely not, says investor KM Capital.

“I reiterate my bearish thesis because NIO continues to lose its market share as closest peers ramp up much faster, and the race intensifies with new solid players joining the battle,” KM said. “The company continues to be disappointing from the bottom line perspective, which looks inevitable given NIO’s thin, single-digit gross margin.”

The data almost speaks for itself. In Q1, Nio delivered 30,053 vehicles, amounting to a 3% drop compared to the same period a year ago. Meanwhile, deliveries at some of its closest peers such as Li Auto and XPeng, increased on a year-over-year basis. Thus, it’s clear Nio is “losing its market share to competitors.” Furthermore, while XPeng’s profitability profile is not much better, Li Auto has already achieved profitability across all major metrics, positioning it advantageously compared to Nio.

But if that already makes the industry competitive enough, the field has now gotten even tougher. Chinese tech giant Xiaomi recently launched its own EV with the car selling out in the first 24 hours following its official sales launch. KM thinks it is a direct rival to Nio’s ET7, but while Nio’s ET7 sedan goes for $70,000 and above in China, Xiaomi’s SU7’s pricing starts under $30,000.

“It appears like ET7 will be unable to compete with SU7 in pricing, and I doubt whether NIO will be able to justify the massive gap in prices to customers,” KM opined. “Therefore, I see the emergence of Xiaomi’s car as a big threat to NIO.”

Bottom-line, KM has a Strong Sell rating on NIO shares, along with a $1.57 price target, implying the stock has further downside of a miserable 64% from current levels. (To watch KM Capital’s track record, click here)

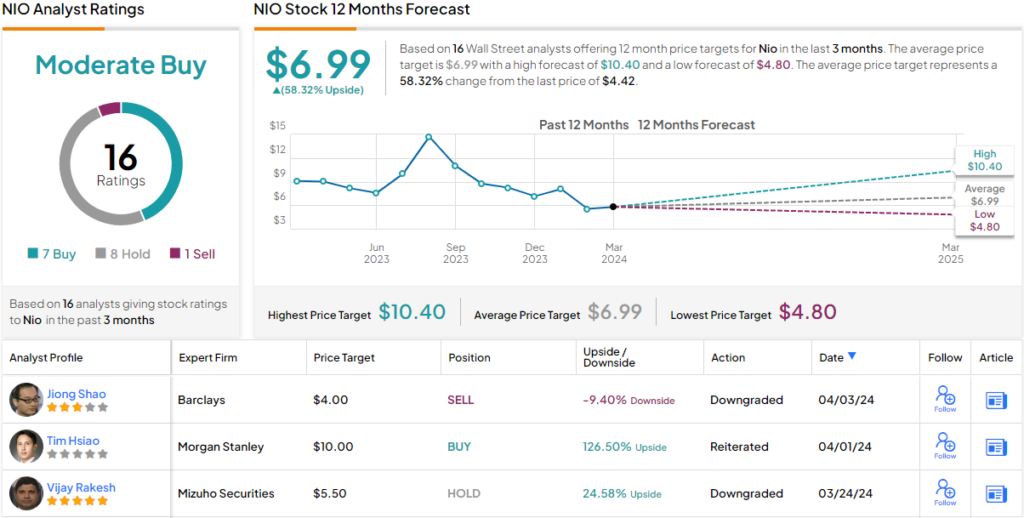

That’s one bearish view, although Wall Street is generally more upbeat; the stock claims a Moderate Buy consensus rating, based on a mix of 7 Buy recommendations, 8 Holds and 1 Sell. The average price target is an optimistic one; at $6.99, the figure makes room for one-year gains of 58%. (See Nio stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.