Shares of the business intelligence platform provider Domo, Inc. (NASDAQ:DOMO) have dropped nearly 32% in the pre-market session today after the announcement of its second-quarter numbers. Revenue rose 5.5% year-over-year to $79.67 million, outperforming expectations by a thin margin of ~$0.8 million. Furthermore, the net loss per share of $0.03 came in narrower than estimates by $0.06.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

During the quarter, while remaining performance obligations (RPO) increased by 2% to $357.6 million, billings dropped by 2% to $70.6 million. The company is seeing momentum in consumption pricing and continues to make advances in AI.

Looking ahead to Fiscal Year 2024, management anticipates revenue to range between $316 million and $320 million, indicating a growth rate of 2% to 4%. EPS for the year is anticipated to be between $0.39 and $0.47.

Additionally, for the third quarter, it expects revenue to land within the range of $78.5 million to $79.5 million, with an EPS forecast between $0.10 and $0.14.

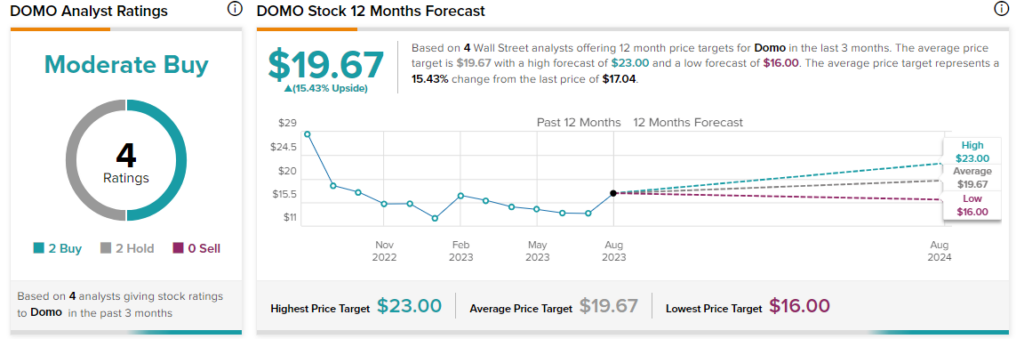

Overall, the Street has a consensus price target of $19.67 on Domo, along with a Moderate Buy consensus rating. Today’s price decline follows an increase of nearly 22% in Domo shares so far this year.

Read full Disclosure