Following the announcement of its turnaround initiative, Dollar Tree (NASDAQ:DLTR) experienced a roughly 5% increase in its stock price on Wednesday. The discount retailer has set ambitious goals for its future, aiming to achieve earnings per share (EPS) of at least $10 in Fiscal 2026. To accomplish this, Dollar Tree plans to enhance its supply chains, implement technological updates, and enhance sales productivity.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Prior to the investor conference held yesterday, Dollar Tree reiterated its outlook for the second quarter and Fiscal 2023. The company also provided assurance to investors regarding its ample cash balance to support capital allocation initiatives.

Efforts to Drive EPS Growth

DLTR’s primary objective is to boost sales by revamping its stores. The company plans to renovate these stores and install additional refrigerated doors. Additionally, DLTR plans to open approximately 1,000 new stores each year.

Moreover, it will increase the penetration of private brands to drive gross margins and streamline the store offerings as per customer needs. Lastly, DLTR will enhance marketing efforts to attract more customers.

Dollar Tree is actively working on improving its supply chain by enhancing the truck loading and store delivery processes. This improvement is expected to significantly reduce unloading times, improving overall efficiency. Additionally, the company plans to establish a robust distribution and transportation network to effectively support its store expansion initiatives and optimize its merchandising programs.

To facilitate its turnaround efforts, Dollar Tree has identified several strategic moves. These include implementing wage increases to enhance employee compensation, conducting training programs at all organizational levels to improve skills and knowledge, and modernizing its technology infrastructure to align with industry advancements. These measures are expected to contribute to the company’s overall transformation and help drive its turnaround strategy.

Is Dollar Tree a Buy?

Currently, analysts have a Moderate Buy consensus rating on DLTR stock. This is based on nine Buy, six Hold, and one Sell recommendations. The average price target of $152.38 implies 6.7% upside potential from the current level. The stock is up about 2% so far in 2023.

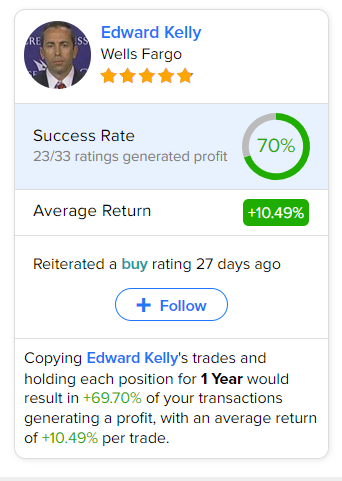

As per TipRanks data, the most accurate and profitable analyst for BMY is Wells Fargo analyst Edward Kelly. Copying the analyst’s trades on this stock and holding each position for one year could result in 70% of your transactions generating a profit, with an average return of 10.49% per trade.