Dollar Tree’s fiscal 4Q earnings topped the Street consensus driven by a rise in same-store sales and gross margin expansion. Shares of the retail company declined 1.3% in Wednesday’s extended trading session after closing almost 3% higher on the day.

Dollar Tree’s (DLTR) 4Q adjusted earnings increased 19% year-over-year to $2.13 per share and beat Street estimates of $2.11 per share. Net sales advanced 7.2% to $6.77 billion missing analysts’ expectations of $6.79 billion.

The company’s enterprise same-store sales grew 5% in the quarter, while same-store sales for family dollar surged 8.1%. Dollar Tree same-store sales rose 2.4%. The gross margin expanded by 80 basis points.

Dollar Tree CEO Michael Witynski said, “As we look ahead, we believe our proven strategic store formats, accelerated store growth plan, 1,250 planned store renovations for the year, several key sales – and traffic-driving initiatives, and a robust balance sheet will enable us to deliver long-term value for each of our stakeholders – customers, associates, suppliers, and shareholders.” (See Dollar Tree stock analysis on TipRanks)

Additionally, the company bumped up its share repurchase authorization plan by $2 billion. Dollar Tree now has a total $2.4 billion share repurchase authorization, including the remaining $400 million of its prior authorization.

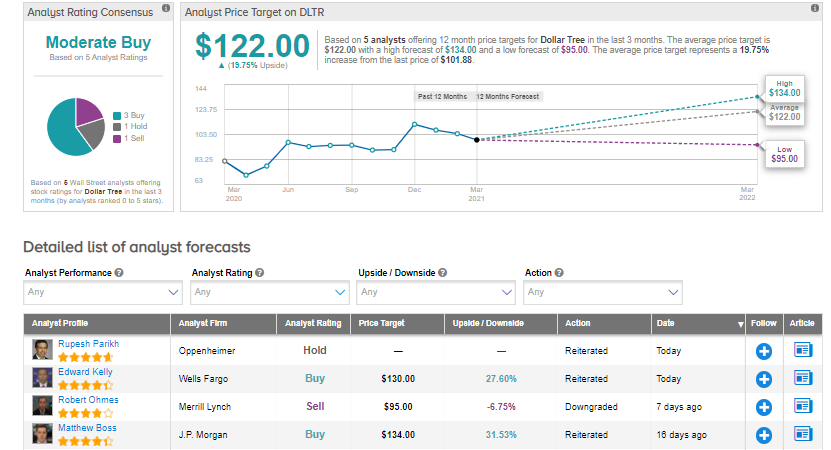

Following the 4Q results, Oppenheimer analyst Rupesh Parikh reiterated a Hold rating on the stock. The analyst “remains concerned on the company’s ability to deliver sustained levels of comp and profit growth.”

Parikh believes “investors are best to remain on the sidelines for now.”

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 3 analysts suggesting a Buy, 1 analyst recommending a Hold and 1 analyst suggests a Sell. The average analyst price target of $122 implies almost 20% upside potential to current levels. Shares have jumped 29% over the past year.

Related News:

Nektar Posts Better-Than-Feared Quarterly Loss, Misses On Revenues

Domino’s 4Q Results Miss Analysts’ Expectations; Shares Tank 7%

Sage Posts Surprise Quarterly Profit As Sales Surge; Shares Pop 6%