Student loan forgiveness has been in the headlines over the past few years. According to the Education Data Initiative, the college tuition inflation rate has averaged 12% annually from 2010 to 2022. It’s no wonder that student loan debt exceeds $1.7 trillion. Navient (NASDAQ:NAVI) was a leading provider of education loan management, though it has taken steps to exit its student loan portfolio. Still, negative price momentum, coupled with a hazy outlook on the company’s reinvention, makes this a troublesome stock that investors may want to avoid until there is further clarity and more positive news.

Navient Exiting Student Loan Servicing

Navient was born out of the 2014 split of loan servicer Sallie Mae and was among the largest servicers of student loans in the United States, managing over $300 billion in government and private student loans. However, by the conclusion of 2024, it is projected that Navient will no longer service any student loans.

In a significant shift, Navient has agreed to transition its student loan servicing to MOHELA, a notable provider of student loan servicing for government and commercial enterprises. This move is expected to generate a variable cost structure for the servicing of student loan portfolios, offering Navient more attractive unit economics across diverse servicing volume scenarios.

As Navient moves forward, the company is exploring strategic options for its Business Processing division, including a potential divestiture, and is working to “streamline [its] shared services infrastructure and corporate footprint.”

Navient’s Recent Financial Results

During the first quarter, the company reported core EPS of $0.47 against a consensus EPS estimate of $0.59. Its net interest margin increased in the Consumer Lending segment, jumping from 291 basis points in the previous quarter to 299 basis points in the most recent quarter. Further, originations surged over 50% to a new high of $259 million compared to $168 million a year ago.

In the Business Processing segment, total revenue hit $77 million, while the EBITDA margin improved from 7% in the previous year to 11%, indicating an increased efficiency in operations.

Management has given guidance for 2024 core EPS to range from $1.55 to $1.75.

Is NAVI Stock a Buy, According to Analysts?

Analysts following Navient have taken a cautious stance on the stock. For example, Barclays (NYSE:BCS) analyst Terry Ma lowered the stock’s price target from $13 to $11 and reiterated an Underweight rating, noting that Q1 results missed estimates and the potential execution risk around the cost reduction plans.

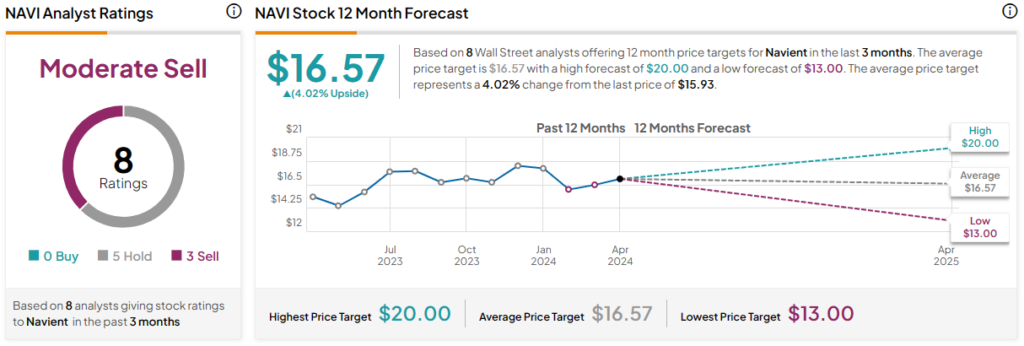

Navient is rated a Moderate Sell based on the recommendations and 12-month price targets eight Wall Street analysts issues over the past three months. The average price target for NAVI stock is $16.57, which represents 4% upside from current levels.

The stock has been trending downward, losing over -7.4% in the past month. It demonstrates negative price momentum, trading below the 20-day (16.88) and 50-day (16.79) moving averages.

Final Analysis on Navient

Navient is trying to reinvent itself, though the strategy articulated for what it will evolve into is ambiguous thus far. Until further clarity on the firm’s direction post-transition away from servicing the student loan portfolio, investors are best served watching from the sidelines.