It’s a lonely occupation betting against semiconductor juggernaut Nvidia (NASDAQ:NVDA), which is why no one does it. The most you’re going to find among Wall Street experts are a rare handful of Hold ratings. However, because seemingly everyone is amped up about the company’s upcoming earnings report, relatively few appreciate the risks tied to attempting to hit ever-rising financial targets. Given the data, I am near-term bearish on NVDA stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Even NVDA Stock Needs a Breather

Fundamentally, the core concern surrounding NVDA stock centers on the underlying company’s ability to keep impressing. For example, a couch potato determined to make good on a new year’s health and fitness resolution can enjoy significant gains through relatively minor effort exerted. However, track superstar Usain Bolt in his prime would only accrue incremental performance returns, if anything.

Obviously, one is starting from a low base and, therefore, benefits from the presence of low-hanging fruit. In the case of Bolt and NVDA stock, these elite players only face high-hanging fruit. Further, with Nvidia continuing to impress onlookers with its blistering financial performances, the expectations continue to accelerate. At some point, the fruit will be hanging so high that it will require the use of a crane to reach it.

On the anticipated date of February 21, Nvidia will disclose its results for the fourth quarter of Fiscal 2024. Analysts call for the company to deliver earnings per share of $4.59, well above the 81 cents it posted in Q4 of the prior year. In Q3, Nvidia posted EPS of $4.02 against the consensus of $3.37. Therefore, another beat isn’t out of the question.

Additionally, those bullish on NVDA stock will point to Nvidia’s dominance in AI-centric graphics processing units (GPUs). As well, booming demand in the data center ecosystem may help undergird Nvidia’s top and bottom lines. Finally, several industry analysts have talked about a second wave in AI that may facilitate incredible advancements in machine learning and neural networks.

You’ll find few who disagree with the fundamental catalysts augmenting NVDA stock. However, these are also known catalysts that have likely been priced in.

Too Much Bullishness Baked Into the Nvidia Trade

Fundamentally, one of the biggest issues with NVDA stock is that based on transactions recorded in the unusual options activity screener – the arena where the smart money is arguably most active – not much incentive exists for bearish traders when trading for intrinsic value (as opposed to gambling on extrinsic value appreciation).

For example, for options seeing unusual activity that expire on June 21, 2024, the cheapest call based on total cost (that is, the cost to exercise added to the total contract premium) is the $675 call, with an outlay of $79,220. While steep, based on a linear trajectory of the most optimistic price target, by the June 21 expiration, NVDA stock may be worth $884.09 per share.

Multiply the aforementioned figure by 100 shares, and the value comes out to $88,409. However, you would be profitable because the cost to acquire this position was $79,220.

Now, consider the put side of the argument. The cheapest June 21 put, which would even have a chance of being profitable (that is, the strike price is higher than the market price), is the $675 put. Based on the most pessimistic price target, NVDA stock may drop to $670.75 by the expiration date. At the gross level, you would have a contract that allows you to sell NVDA at $675 as opposed to nearly $671.

However, the premium for this put stands at $52.40. Multiply that by 100 shares added to the cost of exercising, and suddenly, it makes zero sense to buy this put if you’re going strictly for intrinsic value.

What’s more, looking out to the February 21, 2025 expiration date, the cheapest call in terms of total contract price is the $700 strike. Here, investors can expect to pay $86,880 (contract premium of $168.8 multiplied by 100 shares plus the exercising of 100 shares at $700). However, if NVDA stock can reach the highest analyst target of $1,200, the position would yield a profit of $33,120.

On the flip side, the cheapest put for the February 21 expiration date is the $730 put. Here, investors must pay a total cost of $84,600 (contract premium of $116 multiplied by 100 shares plus the exercising of 100 shares at $730). Should NVDA stock fall to the lowest price target of $560, the position would profit only $5,400.

Of course, one could always buy, say, the $600 January 2025 put and speculate on the value of the contract increasing ahead of schedule. However, such a wager represents a deeper risk that the option will not be salvageable or even close to being salvageable. In contrast, the call side features many avenues for speculation at more relatively attractive rates.

Ultimately, this framework incentivizes traders to go long, which seems aggressive. Yes, Nvidia is a true juggernaut, but no company rises higher indefinitely.

A Major Warning Issued

Another element that makes me jittery about the excessive bullishness in NVDA stock stems from a major warning sign that hit last Friday. Shares of Super Micro Computer (NASDAQ:SMCI) tumbled 20% following a stratospheric run since the beginning of this year. Even with the fallout in SMCI, it’s still up over 182% year-to-date.

Nevertheless, that’s a deafening shot across the bow regarding the rabid AI-driven enthusiasm for the company. Yes, the company’s server and storage solutions offer significant implications for digital intelligence. However, some analysts have argued that this narrative is already priced in.

Frankly, the same could be said about NVDA stock. Again, no one doubts that Nvidia will play a dominant role in the processes of the future. However, sentiment is too far stacked on one side of the trade.

Is NVDA Stock a Buy, According to Analysts?

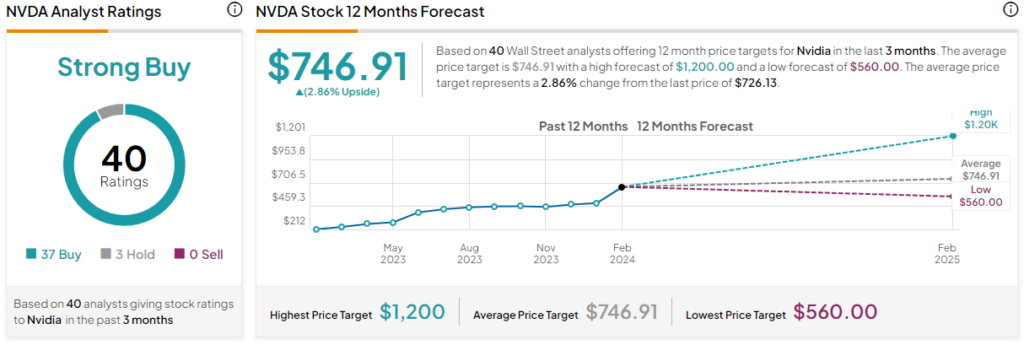

Turning to Wall Street, NVDA stock has a Strong Buy consensus rating based on 37 Buys, three Holds, and zero Sell ratings. The average NVDA stock price target is $746.91, implying 2.86% upside potential.

The Takeaway: Even NVDA Stock Will Need a Breather Soon

It can’t be stressed enough: Nvidia is an amazing enterprise with a profoundly encouraging future ahead of it. With its dominance in GPUs that can help power the latest AI-based innovations, it’s well-positioned for the long run. However, data from the options market suggests that sentiment is excessively stacked in favor of the bulls. Given the increasingly rising expectations, investors need to be cautious about NVDA stock in the near term.