Retailers have been under pressure due to the impact of macro uncertainty on consumers’ discretionary spending and tariff woes. Nonetheless, Wall Street is bullish on some retail stocks due to their ability to thrive despite short-term challenges. Using TipRanks’ Stock Comparison Tool, we placed Dollar Tree (DLTR), Five Below (FIVE), and Walmart (WMT) against each other to find the best retail stock, according to Wall Street analysts.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Dollar Tree (NASDAQ:DLTR)

Dollar Tree stock has risen 20.4% year-to-date, driven by the discount store chain’s efforts to improve its business and the sale of the Family Dollar business that weighed on the company’s overall performance in recent years.

Investors are also optimistic about Dollar Tree’s strategic initiatives, including its multi-price point strategy. The retailer finished Fiscal 2024 with approximately 2,900 3.0 multi-price format stores, and is targeting 5,200 3.0 format stores by the end of 2025.

Dollar Tree is scheduled to announce its results for the first quarter of Fiscal 2025 on June 4. Wall Street expects the company to report a 15.4% decline in EPS (earnings per share) to $1.21, while revenue is estimated to fall by more than 40% to $4.54 billion. These estimates reflect the impact of the sale of the Family Dollar business, weakness in consumer spending on discretionary items, and tariff-related pressures.

What Is the Target Price for DLTR Stock?

Heading into the Q1 FY25 results, Telsey analyst Joseph Feldman increased the price target for Dollar Tree stock to $95 from $82 and reiterated a Hold rating on the stock. The analyst stated that he is maintaining his Q1 2025 and 2025 estimates, thanks to DLTR’s increased focus on productivity and profitability due to improving value, convenience, and discovery at its stores. He also expects the retailer to gain from its strategic initiatives, including plans to open about 400 new stores in 2025, expand its multi-price point assortment, and refresh its merchandise.

While Feldman highlighted Dollar Tree’s strong balance sheet and potential share repurchases, he believes tariff risk remains elevated in H2 2025 and 2026, given that the company directly imports about 40% of its total retail value purchases, mainly from China. Although the company plans to manage and mitigate a large part of tariffs, Feldman believes that overall exposure to imports is high, and the uncertainty related to changes in government policies remains a risk.

Wall Street has a Moderate Buy consensus rating on Dollar Tree stock based on six Buys, 11 Holds, and one Sell recommendation. The average DLTR stock price target of $85.29 implies a downside risk of about 5.5% from current levels.

Five Below (NASDAQ:FIVE)

Five Below is a value retailer that targets teens and pre-teens with merchandise that is mostly priced between $1 and $5, with some items priced beyond $5. FIVE stock has risen 11% so far in 2025, driven by a favorable update on Q1 FY25 results. Also, the temporary agreement between the U.S. and China to slash tariffs also improved investor sentiment.

The company is scheduled to announce its Q1 FY25 earnings on June 4. In early May, Five Below raised its Q1 FY25 guidance, with net sales expected to come in at about $967 million compared to the prior guidance of $905 million to $925 million, and comparable sales estimated to rise about 6.7% compared to the prior guidance of about flat to 2% increase. Further, Five Below expects Q1 FY25 adjusted EPS in the range of $0.82 to $0.84, up from the prior outlook of $0.50 to $0.61.

Meanwhile, Wall Street expects Five Below to report EPS of $0.78, reflecting a 30% year-over-year growth. Revenue is expected to grow 18.5% to $961.25 million.

Is Five Below a Good Stock to Invest?

Following the Q1 update, Citi analyst Paul Lejuez increased the price target for Five Below stock to $121 from $80 and reaffirmed a Hold rating. The 5-star analyst noted that the company’s revised Q1 FY25 comps guidance was well ahead of the previous outlook.

Lejuez added that with comparisons easing significantly in Q2 FY25, he sees the possibility of Five Below delivering double-digit comparable sales growth, driven by its efforts to improve its assortment and simplify the pricing strategy. Further, the analyst expects Five Below to maintain its Fiscal 2025 outlook despite tariffs.

With six Buys, 13 Holds, and one Sell recommendation, Wall Street has a Hold consensus rating on Five Below stock. The average FIVE stock price target of $98.53 implies about 15.6% upside potential from current levels. FIVE stock has advanced 11% so far in 2025.

Walmart (NYSE:WMT)

Big-box retailer Walmart delivered better-than-expected earnings for the first quarter of Fiscal 2026, though sales slightly lagged expectations. The company attributed its performance to higher transaction counts and unit volumes, along with robust e-commerce growth.

While Walmart is not immune to tariffs, it is considered more resilient compared to its rivals due to its greater exposure to groceries and essentials compared to rivals who sell more discretionary goods. Moreover, the retailer is able to attract customers with its lower prices. Walmart is also strengthening customer engagement with faster deliveries, store remodels, and a wider assortment of brands.

Is Walmart Stock a Buy, Hold, or Sell?

In reaction to the Q1 FY26 print, Raymond James analyst Bobby Griffin reiterated a Buy rating on Walmart stock with a price target of $105. The 5-star analyst noted that Walmart exceeded Q1 estimates and reaffirmed its FY26 guidance despite heightened macro and tariff-related uncertainty. Griffin believes that Walmart is uniquely positioned to navigate the ongoing challenges, thanks to its diversified sourcing, replenishable assortment, disciplined inventory planning, and a structurally advantaged model across e-commerce and supply chain.

He added that Walmart continues to lean into high-margin revenue streams, with advertising, membership, and marketplace all delivering strong growth and expanding contribution to profit. Griffin highlighted that Walmart’s e-commerce business turned profitable in the U.S. and globally for the first time, a key milestone that supports long-term EBIT margin expansion. Over the long term, Griffin continues to view Walmart as a well-positioned retailer that can grow its operating income faster than sales, as the profit mix shifts further toward digital, data, and automation-enabled initiatives.

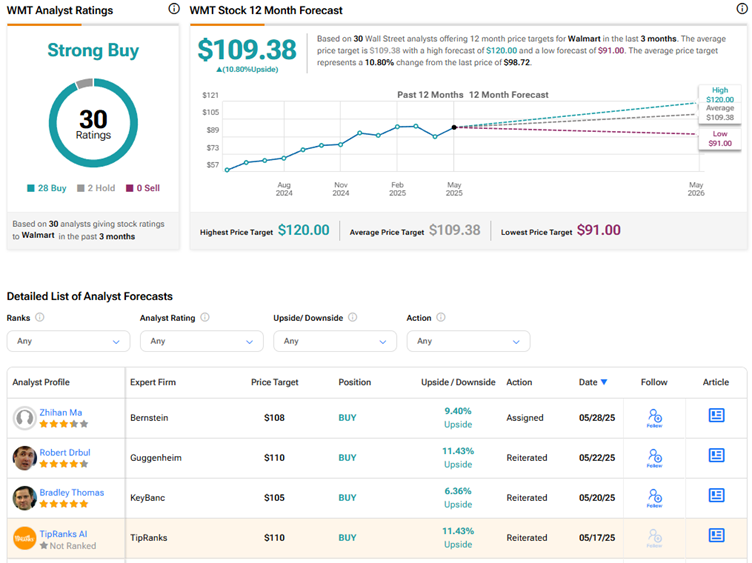

Overall, Walmart scores a Strong Buy consensus rating based on 28 Buys and two Holds. The average WMT stock price target of $109.38 implies about 11% upside potential from current levels. WMT stock has risen 9.3% year-to-date.

Conclusion

Wall Street is highly bullish on Walmart, cautiously optimistic on Dollar Tree, and sidelined on Five Below stock. Currently, analysts see downside risk in Five Below and Dollar Tree stocks, while they expect further upside in WMT stock. Walmart’s value proposition, robust e-commerce growth, and huge scale are some of the strengths that support analysts’ bullish thesis.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue