Cathie Wood is one of the most closely watched names in investing. As the founder and CEO of ARK Invest, she’s known for making bold bets on companies that are shaping the future – often before the market catches on. Through ARK’s family of exchange-traded funds (ETFs), Wood actively manages portfolios that focus on innovation across industries like artificial intelligence, genomics, robotics, and fintech. Her trades have become daily reading for investors eager to follow where the “Queen of Disruption” is putting her money next.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On Tuesday, October 14, Wood’s ARK funds were busy once again, featuring a mix of buys and sells across her flagship ARK Innovation ETF (ARKK) and the ARK Space Exploration & Innovation ETF (ARKX). Here’s a closer look at what caught her attention.

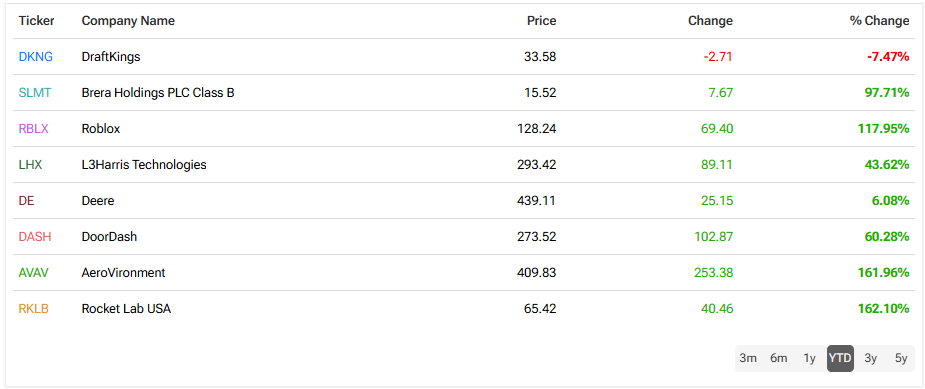

It was a buying day for DraftKings (DKNG), with ARKK snapping up 236,289 shares of the online sports betting company. DraftKings has been at the forefront of the U.S. sports wagering boom, offering everything from fantasy leagues to mobile betting platforms across multiple states.

Meanwhile, ARKK trimmed its exposure to Brera Holdings (SLMT), selling 23,659 shares. The micro-cap company, known for its investments in sports management and media ventures, has seen its stock fluctuate sharply this year.

The fund also offloaded 30,276 shares of Roblox (RBLX). Roblox remains a dominant force in the gaming metaverse and its stock has been trading near all-time highs. The company continues to expand its immersive platform and monetize its vast user base, positioning itself as one of the leaders in interactive entertainment.

In her ARKX fund, Wood made a few small buys today. The fund picked up 8,901 shares of L3Harris Technologies (LHX), a major defense contractor and aerospace systems provider.

Wood also bought 2,966 shares of Deere & Co. (DE), the legendary agricultural and construction machinery maker. While Deere might not seem like a space or innovation play at first glance, its growing focus on autonomous and AI-driven farming technology fits neatly into ARK’s vision of tech-driven productivity.

Another addition came in DoorDash (DASH), with ARKX scooping up 4,823 shares. The food delivery leader continues to expand beyond takeout into groceries, convenience, and logistics.

On the selling side, ARKX pared back 3,890 shares of AeroVironment (AVAV), a drone and unmanned systems maker that has benefited from increased defense spending.

Finally, the biggest move in ARKX was the sale of 53,917 shares of Rocket Lab (RKLB). The space launch provider is ARKX’s largest core holding. It stands out as one of the few private-to-public success stories in the commercial space sector, offering small satellite launch services and developing advanced spacecraft components.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.