It probably should have been considered better news than it actually was, as media giant Disney (NYSE:DIS) revealed that its planned Anaheim expansion got approval from the local government. But shareholders didn’t see it that way at all and instead sent shares down

It was unanimous. The Anaheim city council agreed to Disney’s plan, which will feature $1.9 billion in spending over the next 10 years to see the Disneyland park expand once more. It’s not completely final yet, though, as a final vote is set for May. However, the unanimous decision certainly suggests that further approval should be forthcoming.

The plan calls for Disney to take advantage of some of its existing footprint—mostly already-paved parking lots—to build new attractions. Meanwhile, the parking function will be moved to an upcoming new parking garage. This is, reports note, the first major expansion since the 1990s.

“The Biggest Rip-Off in America”

The bad news of such a plan is that it comes at a terrible time, as most potential customers are struggling to pay their grocery bills. While the economic landscape is likely to change substantially between now and whenever the new expansion finishes, it’s still kind of a risk on Disney’s part. Worse, with commentators calling Disney “the biggest rip-off in America,” that doesn’t exactly lend a lot of support to the project.

In fact, over the last 50 years, reports note that Disney park prices are up a whopping 5,157.14%. Still, it’s a risk it really can’t afford not to take, particularly as Comcast’s (NASDAQ:CMCSA) Universal theme parks also build on.

What Is the Target Price for Disney Stock?

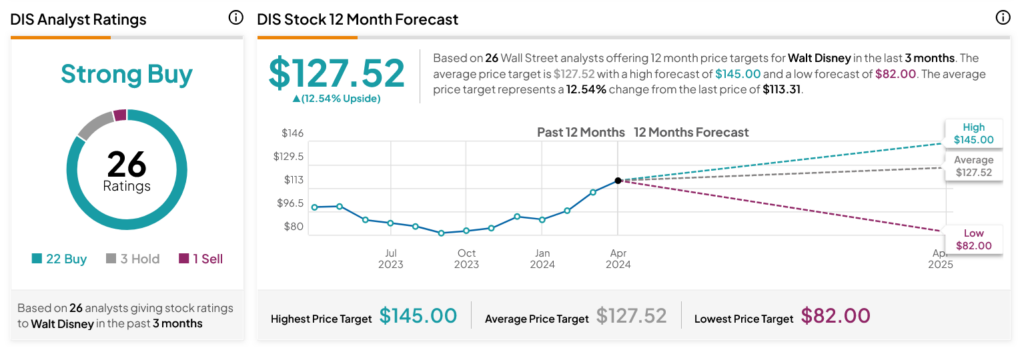

Turning to Wall Street, analysts have a Strong Buy consensus rating on DIS stock based on 22 Buys, three Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 12.51% rally in its share price over the past year, the average DIS price target of $127.52 per share implies 12.54% upside potential.

Is It Wise to Allocate $1,000 Toward DIS Stock Right Now?

Before you hurry to invest in DIS, think about the following:

TipRanks’ team has built the Top Stocks Portfolio for investors, and Disney is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant gains in the years ahead.