Disney stock (NYSE:DIS) has built momentum in recent months. However, I urge investors to approach Disney with caution. Sure, Disney has made progress in its strategic transformation, including improving operating earnings in streaming, delivering growing results in its Parks and Experiences segment, and achieving cost reductions across the board.

Still, legacy TV continues to underperform, its DTC (Direct-to-Consumer) segment keeps losing money, and analysts may be too optimistic about Disney’s future earnings. Thus, I’m neutral on the stock.

Entertainment Segment: Legacy TV Lags, DTC Struggles with Profits

To thoroughly understand Disney’s current state, let’s examine both of its segments separately. Starting with Entertainment, my main concern here is that its legacy TV business continues to face considerable challenges. As a result, any progress being made in the segment’s direct-to-consumer (DTC) business gets directly offset. Further, the DTC business itself struggles to make money. Let’s look deeper.

For context, Disney’s iconic television networks—such as the Disney Channel, National Geographic, ESPN, and ABC—stood as the company’s main revenue pillars. Today, while Linear Networks remain an essential cash cow for Disney, the evolving media landscape has significantly damaged this business. Undoubtedly, viewer attention has shifted to various other mediums. Evidently, In Disney’s most recent Q1-2024 results, the segment posted a revenue decline of 12% to $2.8 billion.

The bulls could respond by saying that Disney is taking care of TV’s inevitable slow death by growing its DTC business inside the Entertainment segment via Disney+. However, there are two points to note here.

First, even though DTC revenues grew by 15%, the decline in Linear Networks, along with a 38% decline in Content Sales/Licensing and Other revenues (as you can see below), still resulted in Entertainment revenues dropping 7% to nearly $10 billion. Further, DTC still struggles to make money, recording an operating loss of $138 million.

Another thing I want to note about the DTC business is that Disney+ isn’t as strong of an asset as many seem to believe. Yes, DTC revenues grew, and the operating loss of $138 million is a nice improvement from $984 million last year. However, I don’t believe that Disney will have an easy time posting profits in its DTC business.

Higher prices and ad revenues were the main drivers of top-line growth, but Disney+ is gradually losing popularity. The number of subscribers was 146.6 million for the quarter, down from 150.2 million in the previous quarter and even lower from 161.1 million in the prior year period. Thus, Disney is going to have a hard time scaling its margins over time here.

Disney’s numbers become even more disappointing when you consider that Netflix posted 260.3 million subscribers for the same calendar period, up from 247.2 million in the previous quarter and even further up from 230.8 million in the prior year period. Despite being a significantly more mature company, Netflix is clearly eating Disney+’s lunch.

Experiences Segment: Packed Parks, But Growth Could Hit Plateau

On the Experiences front, you have to give credit to Disney, as it has managed to keep its parks packed and drive meaningful revenue and earnings growth. The company saw a wonderful response from guests visiting its newly opened World of Frozen at Hong Kong Disneyland and its first-ever Zootopia Land at Shanghai Disney Resort. Consequently, the segment’s revenues and operating profits grew by 7% and 8% to $9.1 billion and $3.1 billion, respectively.

Nevertheless, I want to highlight that Disney could be hitting a plateau in this segment. Visit volumes have already benefited from the post-pandemic revenge travel rebound, and prices have soared to peaks that rival the tallest towers in the Disney Kingdom. Thus, growth could halt. Management claims that there are many untapped stories waiting to be brought to life in Disney parks. Still, it’s a risk to keep in mind, especially given that Experiences accounted for nearly 80% of Disney’s total operating profit in Q1.

Strategic Transformation Works, But Beware of Future Expectations

Another praiseworthy aspect of Disney’s investment that needs to be assessed with caution is the company’s strategic transformation. In an attempt to improve profitability after years of share price stagnation and shareholder disappointment, the company realized over $500 million in SG&A (selling, general, and administrative) and other operating expense savings in Q1. The company is also on track to meet or exceed its $7.5 billion savings target by the end of this fiscal year.

Nevertheless, beyond savings, I don’t see how Disney is going to meet Wall Street’s earnings growth expectations beyond this year. Consensus estimates forecast EPS of $4.69, $5.51, and $6.10 in FY 2024, FY 2025, and FY 2026, respectively. These estimates imply year-over-year increases of 24.8%, 17.4%, and 10.7%, respectively.

This year’s estimate seems reasonable, given the significant cost savings. However, Disney+ is losing subscribers, and the Liner Networks business should continue to gradually deteriorate. Therefore, to assume that Parks and Experiences will neutralize these declines and even drive further double-digit earnings growth seems far-fetched, warranting caution, in my view.

Is DIS Stock a Buy, According to Analysts?

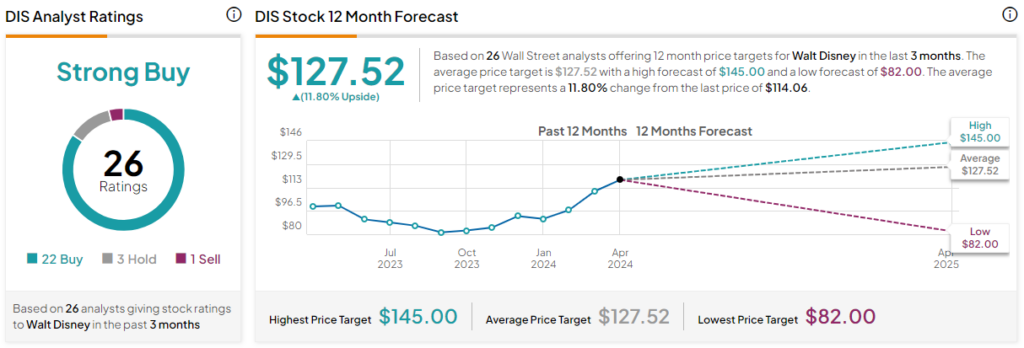

Looking at Wall Street’s view on the stock, Walt Disney has gathered a Strong Buy consensus rating based on 22 Buys, three Holds, and one Sell assigned in the past three months. At $127.52, the average Disney stock price target implies 11.8% upside potential.

The Takeaway

To wrap this up, while Disney has shown promising signs of improvement, particularly when it comes to achieving cost savings and narrowing losses in its DTC business, caution is warranted for investors. With challenges persisting in legacy TV, DTC still losing money, and more importantly, falling Disney+ subscribers, concerns arise.

In the meantime, momentum in Parks and Experiences could slow down, while Wall Street’s estimates appear overblown. Hence, caution is warranted following the recent share price rebound, in my view.