Ahead of The Walt Disney Company’s (NYSE:DIS) shareholder meeting next week, the battle for Board seats has intensified. An institutional investor, The New York City Retirement System has sided with the company’s CEO Bob Iger, and its Board of Directors when it comes to Board seats. On the other hand, investment firm Neuberger Berman has backed hedge fund manager Nelson Peltz‘s Trian Fund Management.

Peltz’s Trian Fund Management is gunning for two board seats on Disney’s Board at its upcoming shareholder meeting while another activist investor, Blackwells Capital also wants Board seats. Trian currently has a 1.76% stake in Disney.

The New York City Retirement System has rejected nominees from Trian and Blackwells Capital as it believes that Disney should get more time to achieve the strategic transformation it is working on under Iger’s leadership. The New York City Retirement System owned $291 million worth of Disney stock at the end of February.

Neuberger Berman Supports Trian’s Nominee

In contrast, Neuberger Berman is supporting Peltz and Trian’s nominee, former Disney CFO Jay Rasulo, for the Disney board, stating that an outsider could be critical to succession planning. Iger has already stated that he plans to leave Disney by the end of 2026. At the end of December, Neuberger owned 1.4 million shares of Disney.

In addition, Blackwells has increased the pressure on Disney and is suing the House of Mouse in a Delaware Court over disclosure concerns regarding the entertainment giant’s dealings with hedge fund ValueAct Capital. Disney called the claims “baseless” and labeled the lawsuit a “desperate” attention-seeking attempt.

Earlier this year, Disney entered into a confidentiality agreement with activist investor ValueAct Capital Management. As a part of this agreement, Disney will communicate with ValueAct, share information, and engage in strategic consultations, including meetings with Disney’s Board and management.

What is the Target Price for DIS stock?

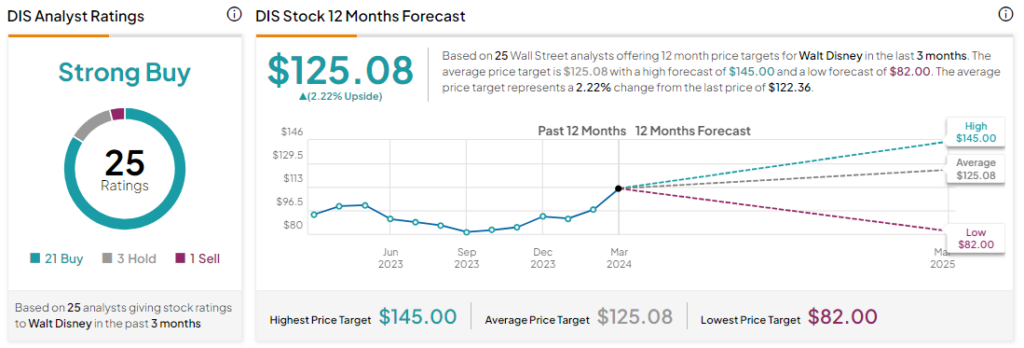

Analysts remain bullish about DIS stock with a Strong Buy consensus rating based on 21 Buys, three Holds, and one Sell. Year-to-date, DIS stock has slid by more than 30%, and the average DIS price target of $125.08 implies an upside potential of 2.2% at current levels.