Sports-focused live TV streaming platform FuboTV (NYSE:FUBO) has filed an antitrust lawsuit against Walt Disney Company (NYSE:DIS), FOX Corp. (NASDAQ:FOXA), and Warner Bros. Discovery (NASDAQ:WBD). Fubo alleged that these media and entertainment companies are engaging in anti-competitive practices and raising prices for consumers.

The move comes after Disney, Fox, and Warner Bros. Discovery announced a new joint venture to build a compelling streaming sports service. Set to debut in the fall of 2024, this platform will combine the companies’ sports networks, direct-to-consumer services, and sports rights, featuring content from major sports leagues and college sports.

Allegations in Detail

Fubo alleges that these media conglomerates have consistently hindered its sports-first streaming service through anti-competitive actions. Moreover, they imposed higher content licensing rates, and restricted product offerings. Fubo added that these tactics have hurt Fubo and its clients financially.

Pointing to the new joint venture between DIS, WBD, and Fox, Fubo said this move would monopolize the sports-streaming market, eliminating competition and harming consumers. Together, these media companies control over half of the U.S. sports rights market, amplifying their impact on the industry, Fubo added.

Fubo is pushing for fair treatment regarding pricing and terms from these media entities to establish a fair playing field. Fubo seeks to block the joint venture and is looking for substantial damages.

What is the Prediction for FUBO Stock?

FUBO stock closed nearly 23% lower on February 7 due to concerns around competition following the announcement of the above-mentioned joint venture. Further, this penny stock (learn more about penny stocks here) is down about 37% year-to-date.

However, the company is growing its paid subscriber base, expanding its average revenue per user, and is on track to achieve positive cash flow in 2025, keeping analysts positive.

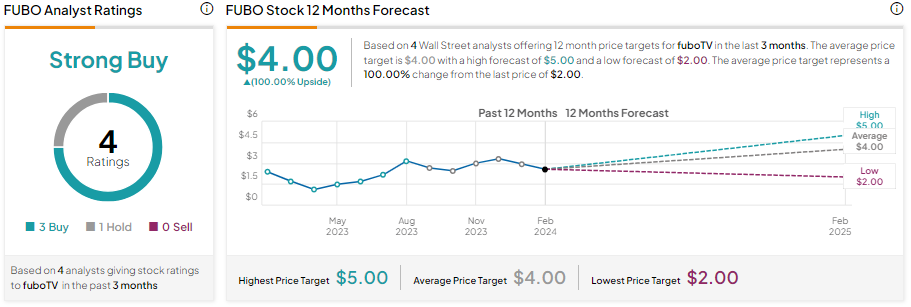

FUBO stock has a Strong Buy consensus rating with three Buy and one Hold recommendations. Meanwhile, analysts’ average price target of $4 implies it could double over the next 12 months.