Retailers like Dillard’s (NYSE:DDS) have not had a good run of things lately. With consumers getting increasingly skittish about their finances and pulling in accordingly, it’s looking like thin times ahead. However, Dillard’s managed to buck the trend and post some unexpected gains, leaving Dillard’s ahead over 11% at one point in Thursday afternoon’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Dillard’s second quarter earnings report proved to be a hit, coming in at $7.98 per share against analysts’ estimates of $4.62. Meanwhile, revenue came in ahead of estimates as well, with Dillard’s posting $1.6 billion against analyst expectations of $1.55 billion. Though there was a down note even to this; revenue was down 1.3% against the second quarter of 2022’s figures. While Dillard’s saw cautious consumers in the first quarter, optimism started to kick in with the second quarter’s figures, according to word from CEO William T. Dillard.

Reports noted that Dillard’s managed to get ahead not so much on the strength of its fashion offerings, but rather its home and furniture categories. Cosmetics also proved a boon for Dillard’s performance, as those were the top three performing categories overall. Home and furniture also offered the help of a “significant” boost in gross margins, even as overall gross margin slipped slightly from 41.5% to 40.4%. In the past, we’ve seen something of a pivot away from home goods back toward clothing as people go out ahead and offices encourage—if not demand—a return to the physical office, and Dillard’s seems well-positioned to gain in both sectors.

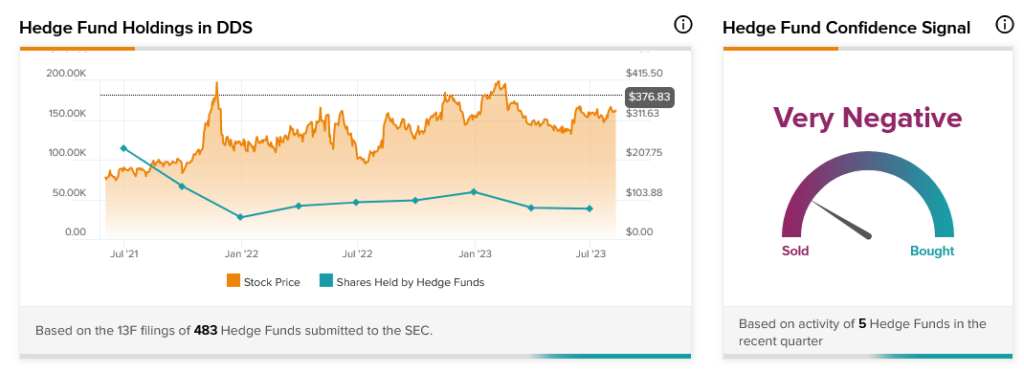

Even with Dillard’s surprising recovery, hedge funds are much less convinced. Hedge fund confidence is currently considered “very negative”, as hedge funds sold a combined 20,000 shares in the last quarter. Worse, this is the second consecutive quarter in which hedge funds have sold shares.