D.R. Horton (NYSE:DHI) shares jumped by nearly 3% in the early trading session today after the homebuilding company posted robust second-quarter results.

DHI’s Strong Performance

Revenue surged by 14% year-over-year to $9.1 billion, surpassing estimates by $960 million. The EPS of $3.52 comfortably exceeded expectations by $0.45, marking a 29% increase in the company’s bottom line.

Despite inflation and elevated interest rates, DHI’s net sales orders surged by 46% sequentially and by 14% year-over-year to reach 26,456 homes. The company closed 22,548 homes valued at $8.5 billion in Q2. Additionally, the cancellation rate decreased to 15% from 18% in the year-ago period. However, its sales order backlog, representing homes under contract, decreased by 7% to 17,873 homes at the end of March 2024.

Moreover, DHI’s revenue from rental operations soared to $371.3 million from $224.1 million a year ago.

Separately, DHI has announced a quarterly cash dividend of $0.30 per share. The DHI dividend is payable on May 9 to investors of record on May 2.

DHI’s Future Outlook

For Fiscal year 2024, DHI expects its top line to hover between $36.7 billion and $37.7 billion. It also anticipates closing between 89,000 and 91,000 homes during this period.

Is DHI a Good Investment?

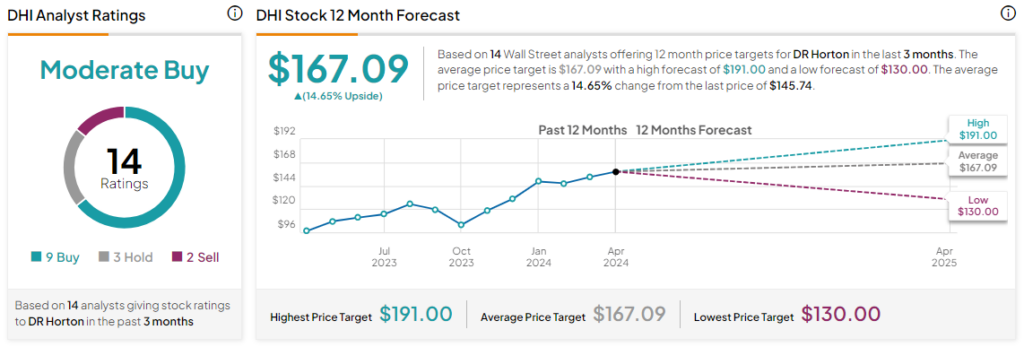

Today’s price gains come on top of a nearly 43% jump in D.R. Horton’s share price over the past six months. Overall, the Street has a Moderate Buy consensus rating on the stock, alongside an average DHI price target of $167.09. However, analysts’ views on the company could see changes following today’s earnings report.

Read full Disclosure