On Thursday, Delta Air Lines (NYSE:DAL) joined its industry peers in cutting earnings projections amid climbing expenses. Facing steeper fuel and maintenance costs than initially anticipated this quarter, the company adjusted its per-share earnings estimate to a range of $1.85 to $2.05, taking a step down from the optimistic $2.20 to $2.50 it predicted earlier. Despite this, it’s not all gloom and doom; Delta anticipates a less drastic dip in unit revenue this quarter, forecasting a decrease of 2-3% compared to last year, an improvement on an earlier estimate that saw sales plunging by up to 4%.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Even as it navigates the turbulence of inflated costs, Delta maintains a steady outlook for Fiscal Year 2023, holding onto its projection of $6 to $7 per share. Yet, this comes at a time when the airline sector is bracing for potentially leaner times, entering a stretch where the appetite for travel may wane. This trimming of quarterly guidance seems to be a cautious maneuver, aligning with an industry grappling with escalating expenditures amid a period of softened travel demand.

Is DAL Stock a Buy?

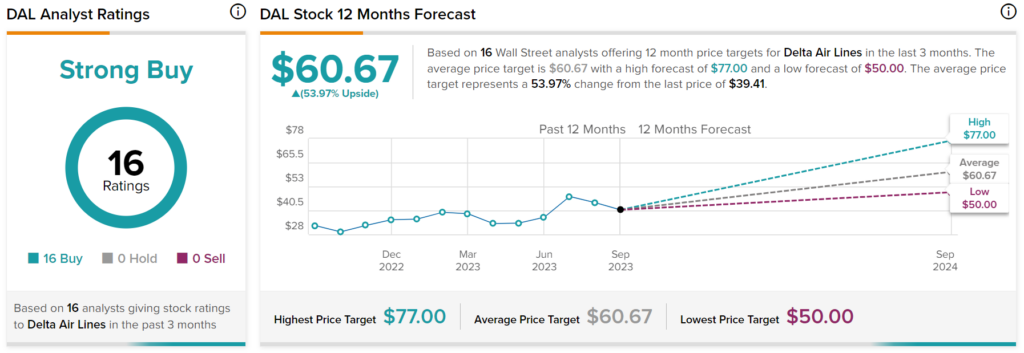

Turning to Wall Street, analysts have a Strong Buy consensus rating on DAL stock based on 16 Buys assigned in the past three months, as indicated by the graphic above. In addition, the average price target of $60.67 per share implies 54% upside potential.